Bitcoin Price Correction Is Not Over Yet; Next Crucial Support Under $70,000

Bitcoin has dropped another 3.10%, falling under $80,000, with analysts predicting the price may fall below $70,000 before recovering. The crypto market is facing pressure amid significant sell-offs on Wall Street, leading to extended losses this week.

Article

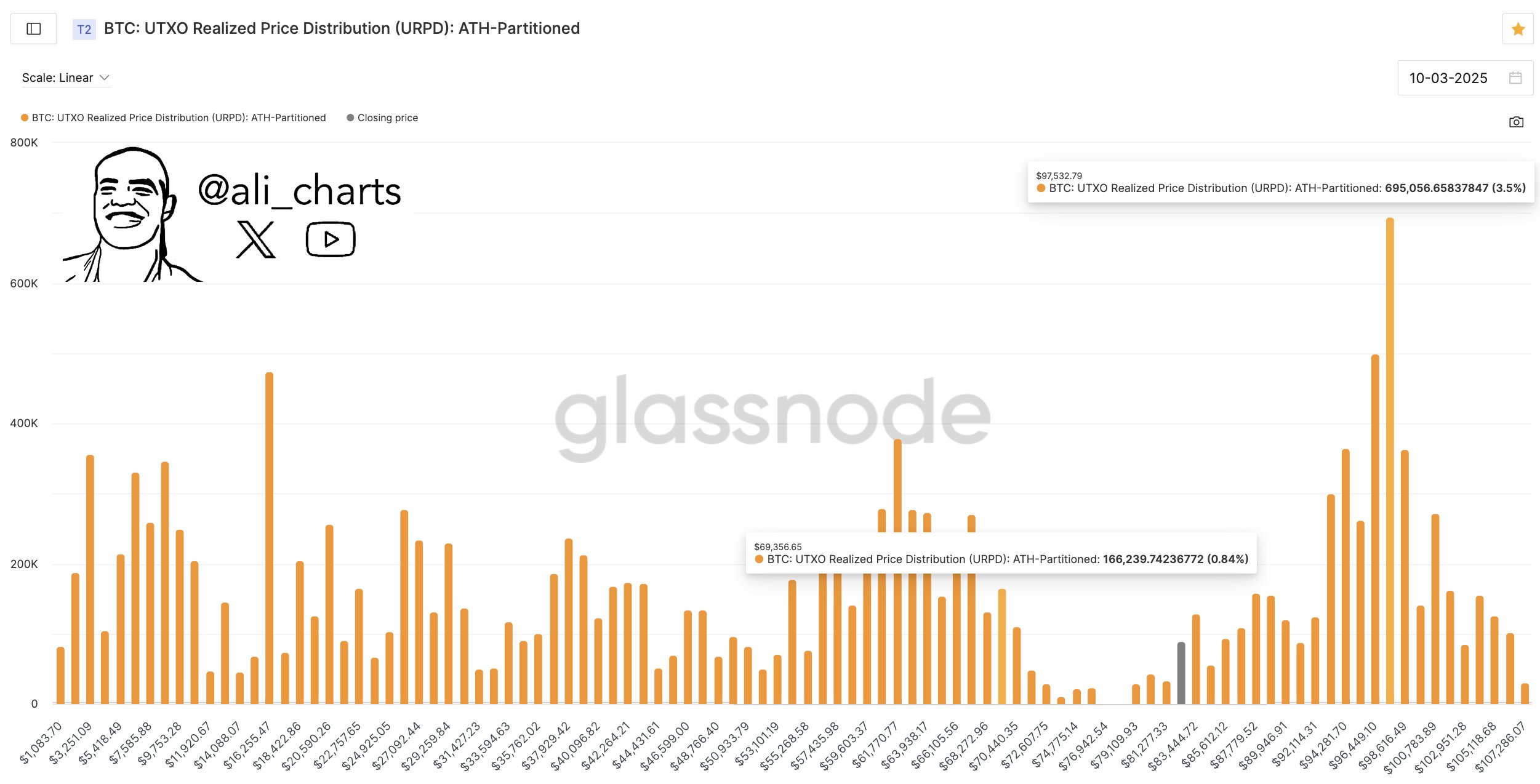

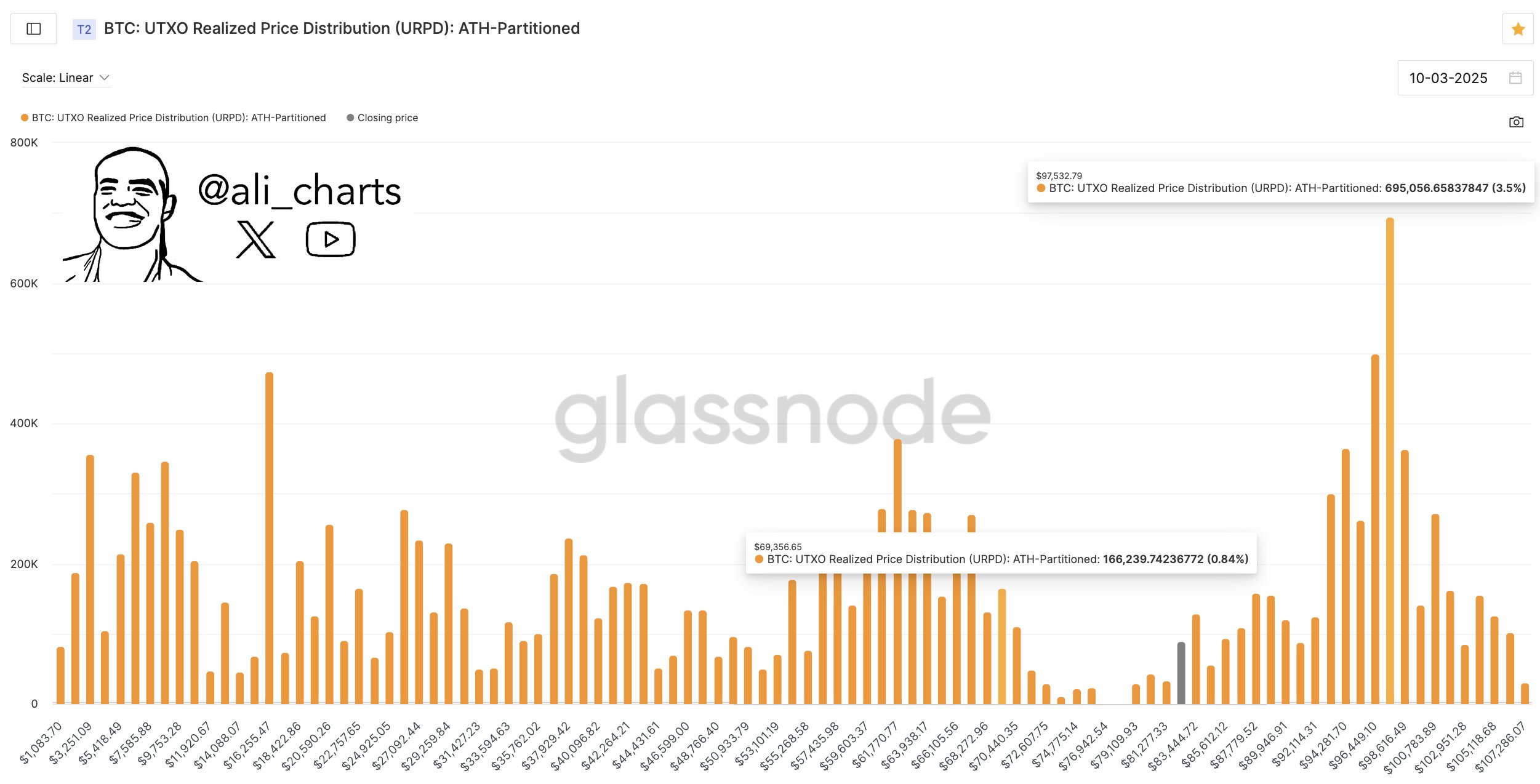

Bitcoin, the pioneering cryptocurrency that has captured the financial world's attention since its inception, has recently faced significant price corrections that have raised eyebrows among investors and analysts alike. As of the latest trading session, Bitcoin has experienced a notable drop of 3.10%, bringing its price to below the critical $80,000 mark. This downward pressure has sparked a growing concern among traders regarding the cryptocurrency's future trajectory and whether this bearish trend is nearing its conclusion or if more turbulence is anticipated. Market analysts are currently suggesting that Bitcoin's recent decline may not be fully over, as there is speculation that it could potentially fall below the psychologically significant $70,000 threshold. Such a drop would mark a stark reminder of Bitcoin's volatile nature. Throughout its history, the cryptocurrency has been characterized by dramatic price swings, and this latest correction could be perceived as a natural phase in its ongoing maturation process. Investors who are closely watching the market should remain vigilant, as navigating these fluctuations can be both perilous and potentially lucrative. This decline in Bitcoin's value coincides with significant sell-offs observed on Wall Street, adding to the strain felt across the broader cryptocurrency market. The correlation between traditional financial markets and cryptocurrencies has grown increasingly complex, with many investors now viewing Bitcoin and altcoins through the same lens as equities and commodities. As stocks have seen declines, the resulting anxiety and uncertainty have rippled through to the crypto space. Congressional debates on potential regulations, fluctuations in interest rates, and broader economic indicators have all contributed to the current market atmosphere, complicating Bitcoin's path to recovery. However, market corrections often present opportunities for savvy investors. Amid the growing sentiment that Bitcoin may be on the verge of hitting new low points, some market participants are considering this as an opportune moment to enter the market at more favorable prices. The theory of buying the dip is a strategy long employed by both seasoned traders and newcomers, where investors seize the chance to acquire assets at a perceived bargain price, banking on the cyclical nature of market recoveries. For those looking to invest in Bitcoin, patience and meticulous market analysis are critical, as timing can greatly influence returns. Despite the potential silver linings, the future direction of Bitcoin's price remains uncertain. As external market pressures mount and investor sentiment wavers, analysts are meticulously monitoring several key support levels that could signal future movements. These levels serve as critical benchmarks to determine whether Bitcoin will hold firm and rebound or if it will capitulate to further declines. Recognizing these indicators could be the difference between realizing profits or incurring losses. In conclusion, while Bitcoin's recent price correction has sparked uncertainty, seasoned investors understand that such volatility is part and parcel of the cryptocurrency market. The prospect of falling below the $70,000 mark raises questions, but it also presents potential buying opportunities for those with a long-term investment outlook. As financial environments continue to evolve, Bitcoin remains a central figure in discussions around digital currencies. It encapsulates both the risks and rewards inherent in this transformative financial landscape. The key for investors now lies in navigating these turbulent waters with careful analysis and strategic planning.

Keywords

Ripple

Ripple

2025-03-11

Blockenza Analysis

Given the ongoing bearish trend and external market pressures, there is a significant risk that Bitcoin's price may continue to fall before any potential recovery.

FAQs

1. What is the current price drop for Bitcoin?

Bitcoin has dropped another 3.10%, falling under $80,000.

2. What do market analysts predict for Bitcoin's future?

Analysts believe the price could drop below $70,000 before resuming an uptrend.

3. What external factors are affecting Bitcoin's price?

Heavy sell-offs on Wall Street are contributing to the ongoing losses in the crypto market.

4. Is the Bitcoin price correction likely over?

Market analysts suggest that the correction is not over yet.

5. What should investors be cautious about?

Investors should be cautious as Bitcoin navigates through a volatile market.

6. Could there be potential buying opportunities?

A deeper correction may present buying opportunities for potential investors.

7. What are analysts monitoring closely?

Analysts are monitoring key support levels to predict Bitcoin's next moves.

8. What impact has Wall Street had on cryptocurrency prices?

The pressure from Wall Street sell-offs has led to extended losses in the crypto market.

9. How should investors approach the current market conditions?

Investors are advised to remain cautious amid these turbulent market conditions.

10. Could Bitcoin recover soon?

While there is potential for recovery, the direction remains uncertain amidst current market pressures.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Pi Network (PI) Expected to Reach New High of $6.54: Here's When

Pi Network (PI) saw significant price increases earlier this year, peaking at $2.99. However, after experiencing a bullish breakout, the price has since dropped by 53.6%.

Ripple

Ripple

2025-03-11

US Stablecoin Bill Receives Update Ahead of Senate Banking Committee Vote

The US Senate Banking Committee is scheduled to vote on the bipartisan GENIUS Act, focused on regulating stablecoins, on March 13. The bill aims to bring larger stablecoin issuers under Federal Reserve regulation, while enhancing consumer protections and imposing strict standards on foreign issuers.

Ripple

Ripple

2025-03-11

Ripple's XRP Faces Bearish Pressure as TD Sequential Signals Weakness

TD Sequential indicators show bearish signals for XRP, with significant concerns about price stability. The presence of a head and shoulders pattern may lead XRP down to $1.50 if support breaks, while holding above $2 could potentially restore investor confidence.

Ripple

Ripple

2025-03-11

Bitcoin Price Correction Is Not Over Yet; Next Crucial Support Under $70,000

Bitcoin's price has dropped 3.10% under $80,000, and analysts expect further decline potentially below $70,000, worsened by Wall Street’s selloff. Altcoins are experiencing even greater drops, indicating a persistent bearish trend in the crypto market.

Ripple

Ripple

2025-03-11

Bitcoin Price Correction Is Not Over Yet; Next Crucial Support Under $70,000

Bitcoin has dropped another 3.10%, falling under $80,000, with analysts predicting the price may fall below $70,000 before recovering. The crypto market is facing pressure amid significant sell-offs on Wall Street, leading to extended losses this week.

Ripple

Ripple

2025-03-11

Grok AI and ChatGPT Predict Remittix Could Outperform XRP by 2027

Grok AI and ChatGPT forecast substantial increases in both XRP and Remittix, suggesting a significant market change is imminent. Experts predict that while Remittix could rise dramatically, XRP is also expected to reach new all-time highs by the second quarter of 2025.

Ripple

Ripple

2025-03-11