Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Article

On October 14, 2024, the cryptocurrency market exhibited signs of significant volatility, notably characterized by a breakout pattern that caught the attention of seasoned traders and new investors alike. The signs of this volatility were not just speculative; they were bolstered by a notable uptick in trading volume, which suggested an increase in market participant engagement and interest. As optimism surged, investors began recognizing the potential for bullish price movements, reinforcing their expectations as substantial green candles formed on November 6 and November 7. These bullish candles signified more than transient fluctuations; they validated the emergence of a robust bullish trend, fueling anticipation for further price appreciation among investors. However, this seemingly unstoppable upward trajectory was notably disrupted when the market faced a steep decline on December 18 and 19, a downturn that sent ripples of concern throughout the trading community. Many traders viewed this abrupt drop as an indicator of a short-term peak, a phenomenon often linked to increased volatility as traders rushed to recalibrate their positions. By early February 2025, the atmosphere transformed dramatically when the market encountered a considerable sell-off. The panic was palpable among traders, as evidenced by the alarming spike in trading volume to 48,900 coins on February 3. This surge underscored the public sentiment of urgency, with many investors seemingly desperate to mitigate their losses amidst the swift market downturn. Compounding these challenges were the critical support levels that appeared to erode under pressure, particularly the pivotal 2,600 mark. The breach of this support area marked an alarming signal as it underscored the growing bearish sentiment among market participants. As we moved into February 2025, technical indicators began to paint an increasingly ominous picture. The short-term moving averages produced a death cross, a historical pattern indicating a transition from bullish to bearish trends, ringing alarm bells for many investors. Complementing this worrisome development was the Moving Average Convergence Divergence (MACD) indicator, which, in alignment with this bearish trend, reinforced the prevailing sense of caution plaguing the market. Throughout this tumultuous phase, an interesting trend emerged: a recent decline in trading volume, which may have hinted at a waning downward momentum. While this decrease could be interpreted as panic selling subsiding, investors were cautioned not to jump to conclusions about a potential market reversal. As the cryptocurrency ecosystem continues to undergo rapid evolution, investors are urged to stay vigilant, monitoring various market indicators that could provide critical insights into stabilization prospects. Specifically, a resurgence in trading volume coupled with a reaffirmation of support levels may hint at recovery and renewed confidence in the market. In addition to these technical considerations, external factors such as regulatory developments and macroeconomic trends have the potential to influence market trajectories significantly. Therefore, a well-rounded investor strategy should account for these variables while keeping an eye on the intricate dance of price movements and market sentiment. As we reflect on the 2024-2025 cryptocurrency landscape, it's essential to emphasize that amidst this volatility lies opportunity. For instance, Rollblock has emerged as a significant presale opportunity, attracting over 50,000 engaged investors and showcasing a remarkable 500% rise in valuation. With its innovative blockchain technology and enticing staking rewards, Rollblock stands out in the crowded crypto market. This project is not merely a fleeting trend but is rooted in a robust community-focused model. Investors are thrilled with the prospects offered by Rollblock, which prioritizes transaction efficiency and user experience. Staking not only maximizes potential returns but also encourages long-term commitment from its community. In this ever-fluctuating market, opportunities like Rollblock are vital, offering a window for potential gains that savvy investors should consider seriously. In conclusion, while the cryptocurrency market has displayed remarkable bullish potential, shifting dynamics have introduced levels of uncertainty that necessitate investor vigilance. The rollercoaster journey through late 2024 into early 2025 serves as a poignant reminder of the need for informed adaptability. Investors who remain proactive, continually analyzing market indicators and trends, are in a better position to navigate this complex landscape. As Rollblock continues to build momentum, early investors may be poised for significant returns, making it an exciting opportunity worth exploring. In the world of cryptocurrencies, the blend of risks and rewards shapes the investment journey; hence, being informed and flexible is the cornerstone of successful navigation in this dynamic market.

Keywords

Ethereum

Ethereum

2025-03-11

Blockenza Analysis

The analysis reveals a predominantly bearish sentiment in the cryptocurrency market, suggesting that prices may continue to decline due to panic selling and technical indicators that signal a downward momentum. Caution is advised for investors.

FAQs

1. What caused the initial bullish trend in late 2024?

The initial bullish trend was driven by increased trading volume and investor optimism, particularly for major cryptocurrencies like Bitcoin and Ethereum.

2. When did the market experience a sharp decline?

The market experienced a sharp decline on December 18 and 19, 2024, raising concerns about a potential peak in prices.

3. What technical indicators suggested a bearish outlook?

The emergence of a death cross in short-term moving averages and unfavorable MACD readings indicated a bearish outlook.

4. How did trading volume change in early February 2025?

Trading volume spiked to 48,900 coins on February 3, 2025, as investors rushed to cut their losses.

5. What is the significance of the 2,600 support level?

The 2,600 support level was crucial, and its breach indicated a growing bearish sentiment in the market.

6. What strategy do investors use during downturns?

Investors often look for 'oversold rebounds' as potential entry points during market downturns.

7. Why is Rollblock considered a promising presale opportunity?

Rollblock offers exceptional growth potential and innovative features, attracting over 50,000 enthusiastic investors.

8. What role do community sentiments play in cryptocurrencies?

Community backing can significantly influence a project's longevity and success, especially in the volatile crypto market.

9. How can investors prepare for market fluctuations?

Investors should assess their risk tolerance, establish clear goals, and remain adaptable to changing market conditions.

10. What is the overall conclusion regarding the market outlook?

The cryptocurrency market presents volatility and uncertainty, prompting investors to remain informed and proactive.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

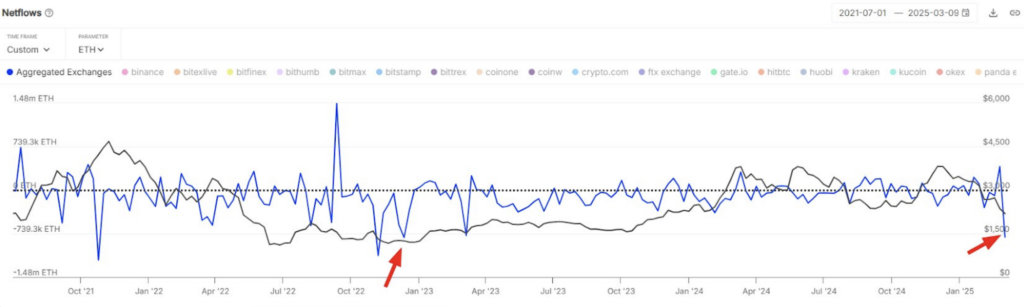

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11