Fundamental Analysis of Ethereum on March 4, 2025

Recent trends in an asset's price reveal significant fluctuations indicative of investor sentiment. Following a period of growth from October to November 2024, the market faced a downturn starting in early 2025, with critical support levels being breached, signaling a bearish outlook and increased volatility.

Article

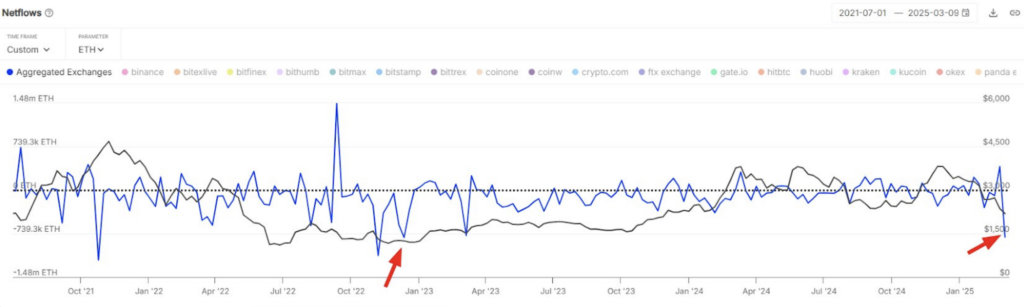

Analyzing the fluctuations of asset prices is essential for investors and traders who aim to glean valuable insights from underlying trends and market sentiment. The recent movements in a notable cryptocurrency asset paint a complex picture, illustrating a blend of rapid increases and subsequent sharp declines that provoke significant interest among market participants. From early October 2024 to mid-November 2024, this asset experienced a noteworthy surge in value. The price rallied significantly, capturing the attention of both seasoned investors and newcomers alike, and fostering a sense of optimism that perhaps a new bullish phase was underway. Analysts point to a confluence of favorable economic indicators, emerging regulatory advancements, and an influx of interest from both retail and institutional investors as key drivers behind this growth. Increased trading volumes throughout this period underscored heightened market participation, with many traders seeking to capitalize on the positive momentum. The atmosphere was further buoyed by the "fear of missing out" (FOMO), a psychological state that tends to electrify speculative behavior and can push asset prices even higher. However, as is often the case in the unpredictable realm of cryptocurrency, this seemingly positive trajectory was not to last. By late January 2025, the market began to shift, and a significant downturn ensued. The dramatic decline culminated on February 3, 2025, when the asset's price experienced a cliff-like drop that struck fear into the hearts of investors, marking the commencement of a bearish cycle. The speed and severity of this decline invited questions regarding the effectiveness and sustainability of the earlier bullish trend. Walls of support that had once been solid, such as the historically significant price level of 2800, were breached. This breach is concerning—it often signifies further potential weakness as it indicates that prior buyer confidence has waned considerably. Coupled with the plunging price was a staggering trading volume that peaked at 48,989 on February 3. Such high volume during a significant price drop signals panic among investors, reflecting an urgency among many to cut their losses amid a climate of fear and uncertainty. This shift in investor behavior is typically a reflection of a combination of negative news, broader market sell-offs, and speculative trading decisions. Investors reacted swiftly to the rapidly changing conditions, attempting to recalibrate their strategies in light of these shifts. To assess the current market momentum, technical indicators like the Moving Average Convergence Divergence (MACD) offer critical insights into potential price momentum changes. In the aftermath of the February drop, the MACD has painted a bearish picture, indicating that selling pressures remain predominant in the short term. Observers now closely monitor for signs of eventual convergence between the two lines of the MACD—such shifts could herald a potential recovery opportunity. Looking to the future, the asset's near-term outlook remains challenging. Investors are advised to stay vigilant. The macroeconomic landscape is fluid, and any developments that could sway sentiment—such as regulatory changes, shifts in liquidity in the market, or impactful announcements from influential players—must be closely monitored. The recent market volatility underscores the necessity for thorough analysis and the formulation of adaptive trading strategies. In conclusion, the turbulent journey of this cryptocurrency illustrates the dual nature of opportunity and risk within financial markets. Participants must stay informed, understanding not only the technical indicators that guide trading decisions but also the psychological undercurrents that influence market behavior. By embracing a cautious yet responsive approach to changing conditions, investors can position themselves to capitalize on emerging opportunities while mitigating potential risks, making informed decisions amidst the high stakes of cryptocurrency trading. In navigating through these unpredictable waters, maintaining a comprehensive strategy that factors in both market data and psychology is paramount for achieving success.

Keywords

Ethereum

Ethereum

2025-03-04

Blockenza Analysis

The analysis indicates a prevailing bearish trend for Ethereum, with recent price movements and indicators suggesting further potential declines.

FAQs

1. What are recent trends in asset price movements?

Recent trends have shown significant upward momentum followed by a dramatic downturn, indicating shifts in market sentiment.

2. What led to the price surge from October to November 2024?

The surge was attributed to favorable economic indicators, regulatory advancements, and increased interest from investors.

3. What happened on February 3, 2025?

On this date, a significant price drop occurred, marking the peak of a bearish cycle that alarmed investors.

4. What is the significance of support levels in trading?

Support levels indicate price floors; breaching these levels can signal further declines and increased selling pressure.

5. What does a high trading volume during a price drop indicate?

High volume typically reflects panic and risk aversion, suggesting that investors are rapidly reassessing their positions.

6. What does the MACD indicator indicate about market sentiment?

The MACD currently suggests a bearish sentiment, indicating that selling pressure remains dominant in the short term.

7. What risks should investors be aware of in the current market?

Investors should monitor macroeconomic factors, regulatory changes, and liquidity shifts that may impact market sentiment.

8. How can investors protect against potential losses?

Implementing stop-loss orders, diversifying portfolios, and conducting thorough market research can help mitigate risks.

9. What psychological factors influence trading decisions?

Market psychology, including fear of missing out and emotional responses to volatility, significantly impacts trading behaviors.

10. What is the outlook for Ethereum moving forward?

The near-term outlook is challenging, and further declines may occur, necessitating cautious investor strategies.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11