Fundamental Analysis of Ethereum on March 6, 2025

The financial markets have been experiencing significant volatility from October 2024 to March 2025, marked by a prevailing bearish sentiment and panic selling among investors. Technical analyses indicate a continued downward trajectory, highlighting the need for cautious and strategic approaches as the market prepares for potential rebounds amidst ongoing uncertainty.

Article

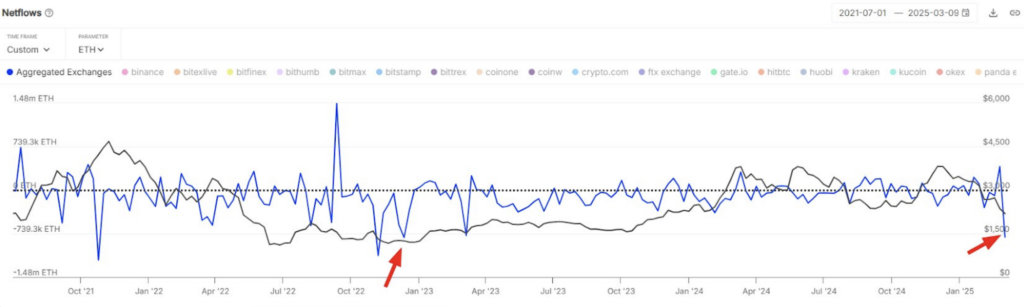

The financial markets' inherent volatility is a characteristic that investors and analysts alike have come to recognize, often leading to unpredictable price movements that can be difficult to navigate. From early October 2024 through early March 2025, we have witnessed a pronounced downward trend in major indices and stocks that exemplifies this instability. During this critical period, market participants have often been engulfed by a pervasive bearish sentiment that has influenced trading behaviors and decision-making processes across the board. At the onset of this period, the market experienced a steady decline, marked by investors' mounting apprehension regarding the global economic outlook. This heightened anxiety was punctuated by a brief upswing in mid-November, a momentary display of optimism that ultimately failed to alter the prevailing negative trajectory. The failure of this uptick to drive a sustained recovery underscores a significant message for market participants: short-term rebounds do not necessarily translate to lasting market health. Instead, the overarching bearish sentiment that dominated this timeframe served as a cautionary signal for investors evaluating their strategies. The situation escalated as the year turned into early 2025, particularly around February 2 and 3, when a significant spike in trading volumes illuminated a wave of panic selling. Traders rushed to offload their positions, reacting swiftly to a slew of negative market news and economic reports that compounded the prevailing fear. This mass exodus of investors not only contributed to the steep decline in stock prices but also reflected a broader trend of declining confidence in the financial markets. As an indicator of such volatility, the market was met with an unprecedented surge of sell-offs that added to the downward pressure on prices. In conjunction with these events, technical analysis techniques have validated the bearish trend, with indicators such as moving averages and the Moving Average Convergence Divergence (MACD) suggesting a sustained downward trajectory. Current support levels hover around 2100, while resistance formations near 3450 present psychological barriers that traders are keenly aware of. These thresholds reflect critical points for potential market movements, underscoring the necessity for investors to remain well-informed about market conditions and trends. As the months have progressed, the impact of adverse economic indicators has been palpable, prompting investors to reevaluate their positions and risk exposure. In such unpredictable conditions, a cautious approach is more critical than ever. Investors are encouraged to implement robust risk management strategies, which may include setting stop-loss orders, diversifying portfolios, and staying attuned to macroeconomic developments that may affect market sentiment. Looking ahead to early March 2025, there exists the potential for a market rebound, contingent upon the stabilization of valuations and a resurgence in investor confidence. However, even the prospect of recovery serves as a reminder of the importance of vigilance in the face of unforeseeable fluctuations. For long-term investors seeking to capitalize on market opportunities, the key lies in a combination of awareness, adaptability, and strategic foresight. In conclusion, the financial markets' unpredictable nature demands that investors remain ever-alert, equipped to respond gracefully to uncertainty. By fostering a keen understanding of market dynamics and relying on analytical tools, investors can adeptly navigate the trials posed by volatile conditions, positioning themselves favorably as the markets evolve. The future remains unwritten, but amid the turbulence, opportunity often arises for those prepared to seize it.

Keywords

Ethereum

Ethereum

2025-03-06

Blockenza Analysis

The analysis indicates a strong bearish trend, with high volatility and panic selling observed in the market, suggesting a likely continued decline in prices. Investors should approach the market conservatively.

FAQs

1. What was the market trend from October 2024 to March 2025?

The market exhibited a clear downward trend characterized by bearish sentiment.

2. Were there any notable increases in market activity during this period?

Yes, there was a brief surge in early to mid-November 2024, but it did not reverse the overall downward trend.

3. What notable trading behavior was observed on February 2 and 3, 2025?

A spike in trading volumes indicated panic selling due to fear-driven market movements.

4. What technical analysis indicators are mentioned?

Moving averages and the MACD (Moving Average Convergence Divergence) indicator are discussed.

5. What levels are identified as key support and resistance?

The primary support level is around 2100, while resistance is near 3450.

6. What investment strategy is recommended given the current market conditions?

A cautious approach is advised, particularly focusing on risk management strategies.

7. Is there a forecast for potential market opportunities?

Yes, analysts predict a volume-driven rise might occur around early March 2025.

8. What is the significance of the MACD values in the analysis?

The MACD values suggest a continuation of bearish trends, emphasizing caution among investors.

9. How do seasonal trends affect market predictions?

Historically, early months often see dips in investor sentiment, leading to potential price lows.

10. What should investors keep an eye on during market fluctuations?

Investors should monitor trading metrics and technical indicators to make informed trading decisions.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11