Fundamental Analysis of Ethereum on March 8, 2025

From October 2024 to March 2025, the cryptocurrency market experienced notable fluctuations, with distinct phases of uptrend, consolidation, and subsequent downtrend, characterized by significant volatility. The bearish sentiment, intensified by adverse economic indicators and technical signals, suggests a cautious approach for investors while recognizing the potential for short-term opportunities.

Article

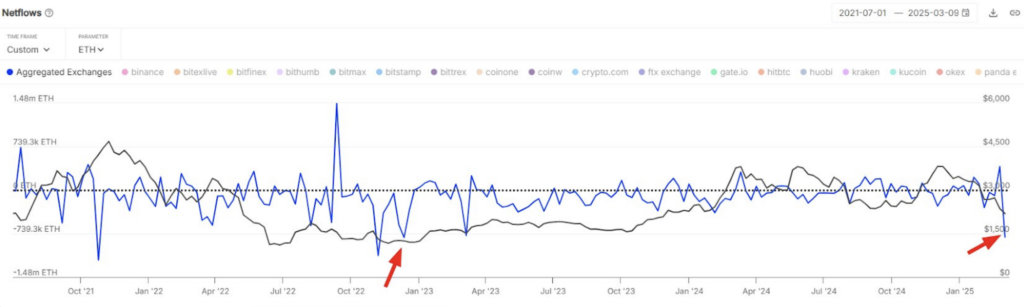

The cryptocurrency market, known for its fast-paced and unpredictable movements, has recently undergone a series of notable fluctuations between October 2024 and March 2025. Throughout this period, the market reflected distinct phases: an initial uptrend, followed by a period of consolidation, and ultimately a significant downturn. This turbulent environment has been characterized by pronounced volatility, leaving both seasoned investors and newcomers striving to decipher the trends and comprehend their implications for future investments. In the early phase of this timeframe, the cryptocurrency market experienced an initial uptrend, as prices surged and caught the attention of investors and speculators alike. Key resistance levels emerged at around $3,700 and $4,000, representing psychological barriers that challenged the assets as they sought to break through and sustain their growth. Resistance levels are critical indicators in technical analysis because they mark zones where selling interest may emerge, potentially stalling or reversing price movements. Conversely, support levels were established around $2,300 and $2,600, serving as historical price points where buyers typically found value. These resistance and support levels created an environment that further encouraged market participants to adopt long positions, often seen as a bullish sentiment amongst traders. However, the market’s trajectory took a sharp turn on February 24, 2025, as prices plummeted below the critical $2,600 support level. This breach sparked a downward price channel where the market formed a series of lower highs and lower lows—an indicator of persistent bearish sentiment. The break below such significant support levels is often perceived as a negative signal, reflecting that selling pressure has outstripped buying interest. Notably, this downturn was not merely a brief fluctuation; instead, it was amplified by a significant surge in trading volume. An increase in trading volume amidst a price drop suggests robust selling pressure, which solidified the prevailing bearish sentiment in the market. The technical indicators, particularly the Moving Average Convergence Divergence (MACD), provided additional evidence of the declining momentum. With a current DIF value of -173.7978 and a DEA value of -158.1241, the readings implied a substantial divergence, favoring the bearish outlook. The negative histogram value of -15.6736 further suggested that downward momentum remained strong, indicating a prevailing sentiment that may discourage potential buyers from entering the market. Looking forward, the expectation remains for continued downward pressure on prices given the sustained bearish sentiment. However, it's crucial to note that in volatile markets, there exist potential opportunities for 'oversold rebounds.' At times, assets may become undervalued, providing strategic investors with attractive entry points to capitalize on potential price corrections when the market stabilizes. For investors contemplating entering the market during this turbulent period, exercising caution is paramount. While opportunities for profitable short-term trades may surface, conditions can pivot rapidly, thereby underlining the importance of sound risk management strategies. Experienced investors should evaluate their risk appetite, establish clear objectives, and develop strategies that can evolve in response to changing market conditions. In conclusion, the period from October 2024 to March 2025 stands as a testament to the inherent volatility of the cryptocurrency market, defined by substantial price fluctuations, trading volume spikes, and significant technical indicators that ultimately shaped trading behaviors. While numerous challenges linger, it is crucial for investors to remain vigilant, informed, and adaptive to rise above the chaos of market fluctuations. With a robust understanding of the dynamics at play and effective strategic foresight, astute investors can identify opportunities, mitigate risks, and navigate through the ever-changing landscape of the cryptocurrency world. As the financial markets continue to evolve, staying informed and responding proactively will remain key to successful investing.

Keywords

Ethereum

Ethereum

2025-03-08

Blockenza Analysis

Based on the bearish trends and indicators discussed in the text, the expectation leans towards further price declines in the cryptocurrency market.

FAQs

1. What is the time frame analyzed in the article?

The analysis covers the cryptocurrency market from October 2024 to March 2025.

2. What occurred during the initial uptrend in prices?

Prices surged, prompting interest from investors but faced resistance at 3,700 and 4,000.

3. What happened on February 24, 2025, regarding support levels?

The price dropped below the 2,600 support level, indicating a shift towards a downward price channel.

4. How does the Moving Average Convergence Divergence (MACD) indicator relate to market sentiment?

The MACD readings suggested a bearish outlook, indicating stronger negative momentum than bullish counteraction.

5. What strategies are recommended for investors during market volatility?

Investors should exercise caution, implement risk management strategies, and consider their risk appetite.

6. What are the support levels mentioned in the article?

Support levels are mentioned at 2,600 and 2,300, suggesting favorable buying points.

7. Is a market rebound possible after the decline?

A potential rebound is conceivable but depends on the stabilization of valuations and recovery of investor confidence.

8. What was the trading volume spike observed around early February 2025?

A significant spike in trading volume indicated panic selling among investors.

9. What does the term 'bearish sentiment' refer to?

Bearish sentiment refers to a prevailing expectation that prices will decline, influencing investor behavior.

10. How does the article suggest investors prepare for future market changes?

It advises investors to remain vigilant and adaptable, leveraging analytical tools and strategies.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11