Technical Analysis of Cryptocurrency on February 3, 2025

The cryptocurrency saw an increase from October to November 2024, followed by a significant decline starting January 2025, culminating in a sharp drop on February 3, 2025. Key resistance levels are identified at 3450, 3700, and 4000, with support levels breached at 3200, 3000, and 2600, warranting cautious trading strategies.

Article

In the ever-evolving landscape of cryptocurrency, fluctuations are the norm, and investors constantly find themselves navigating the capricious tides of this digital financial frontier. The cryptocurrency in question demonstrated a remarkable surge in value, starting from early October 2024 and continuing through to be mid-November 2024. During this period, it became a topic of interest among traders and analysts alike, garnering attention and intrigue as its market performance seemed to reflect burgeoning confidence among investors. The upward trend was characterized by a robust inflow of investment capital and a rising trading volume, signifying strong market participation. Many traders took advantage of this momentum, driving prices higher and causing FOMO—fear of missing out—among potential new investors. This phenomenon encouraged widespread speculation around the cryptocurrency's future value, leading many to believe that the trend signified the start of a new bullish market phase. However, this positive momentum was not to last. As the calendar turned to 2025, the market began to shift with growing unease among investors. By early January, the cryptocurrency embarked on a steep downward trajectory, a rapid decline that many did not foresee. Such abrupt downturns can often do much to unravel investor confidence, and indeed, in the following weeks, a sense of despair engulfed the market, leading to an exacerbation of the decline. The situation escalated on February 3, 2025, when a catastrophic fall in price emerged—an event that analysts likened to a 'cliff-like plunge.' This dramatic descent not only destabilized traders but also triggered a wave of panic across the investor community. When investors are faced with such abrupt and severe downward adjustments, it is not uncommon to witness impulsive selling behavior, usually driven by fear, which in turn exacerbates the drop in prices. The cryptocurrency ecosystem is inherently reactive, and these cascading effects can often lead to further destabilization of asset value. As the market continues to unfold, analysts are closely monitoring key resistance and support levels that hold significant implications for future trading strategies. Resistance levels have been established at 3450, 3700, and 4000, whereas critical support levels have been identified at 3200, 3000, and 2600. Alarmingly, several of these support levels have already been breached, raising concerns about the sustainability of the current price movements and the potential for additional declines. The data surrounding trading volume also paints a sobering picture. After reaching a solid peak of 48,989 units on February 3, 2025, the surge in volume coincided with the price spikes in the previous months, hinting at the role of active trading in driving the cryptocurrency's initial success. However, even as volume surged, the market did not sustain the upward trend, illustrating the volatility and unpredictable nature of cryptocurrency trading. Technical indicators are painting a concerning picture for the cryptocurrency as well. The short-term moving average has crossed below the long-term moving average, a bearish sign known as a "death cross," which historically indicates potential further declines in asset value. Additionally, the MACD (Moving Average Convergence Divergence) indicator is signaling that bearish momentum is gaining strength, further emphasizing the need for traders to tread cautiously. While the potential for a technical rebound exists, it’s vital for traders and investors to remain vigilant about the enduring risks that loom on the horizon. Understanding market psychology, implementing strategies to mitigate losses, and being aware of the long-term risks involved are critical components for navigating these tumultuous waters. This rollercoaster of a market serves as a reminder that while opportunities abound in the realm of cryptocurrency, so too do significant risks that demand careful consideration.

Keywords

Ethereum

Ethereum

2025-03-02

Blockenza Analysis

The analysis indicates a bearish sentiment surrounding the cryptocurrency, suggesting that prices are more likely to fall than rise in the near future.

FAQs

1. What was the trend of the cryptocurrency from October to November 2024?

The cryptocurrency exhibited an upward trend during this period.

2. When did the decline of the cryptocurrency begin?

The decline began in early January 2025.

3. What happened on February 3, 2025?

The cryptocurrency experienced a cliff-like plunge that caused market panic.

4. What are the key resistance levels?

The key resistance levels are at 3450, 3700, and 4000.

5. What are the key support levels?

The key support levels are at 3200, 3000, and 2600.

6. How did the trading volume change from October to November 2024?

The trading volume increased alongside the price rise.

7. What was the peak trading volume on February 3, 2025?

The trading volume peaked at 48,989 units.

8. What does the short-term moving average indicate?

The short-term moving average has crossed below the long-term moving average.

9. What does the MACD indicator suggest?

The MACD indicator shows that bearish momentum has strengthened.

10. What is advised for traders in light of recent trends?

Cautious operation is advised due to long-term downside risks.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

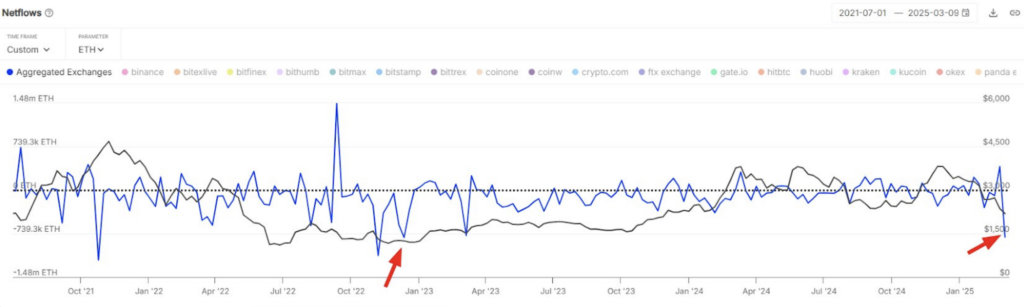

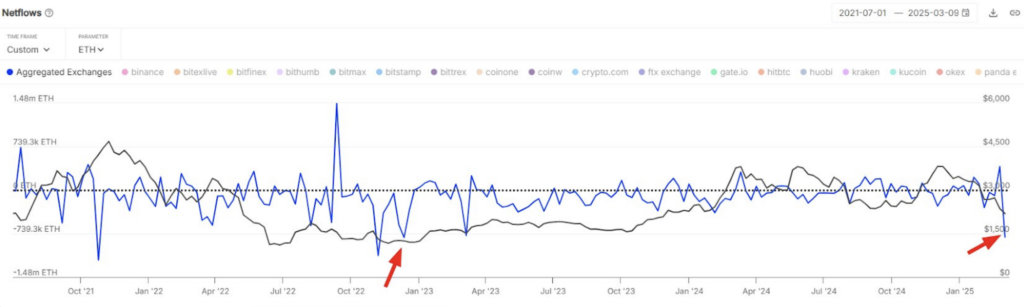

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11