Technical Analysis of Ethereum on February 27, 2025

The market has demonstrated a downward trajectory, hitting a new low of 2336.5 on February 26, 2025, following three days of significant declines. Trading volumes have surged, pointing to heavy selling pressure, with key technical indicators signaling increased downward momentum.

Article

The cryptocurrency market has recently witnessed a pronounced downward trend, creating a climate of apprehension among investors. After achieving a peak value of 2850 on February 23, 2025 (UTC), the market has faced an alarming sequence of three consecutive days characterized by high-volume declines. The price on February 26 (UTC) settled at 2336.5, marking a significant new low point in this downward trajectory. The prevailing atmosphere of uncertainty has been compounded by an extraordinary surge in trading volume, with figures of 17.25, 26.14, and 18.98 BTC recorded between February 24 and February 26 (UTC). These volumes are markedly higher than the average levels observed previously, indicating robust selling pressure and a palpable sense of urgency among traders to liquidate positions. From a technical analysis standpoint, critical indicators reveal concerning signals. The short-term moving average, currently at 2618.38, has recently crossed below the long-term moving average of 2763.62, a phenomenon often referred to as a "death cross." This type of crossover is generally viewed by traders as a bearish signal, suggesting that the market could be poised for further declines. Compounding the bearish sentiment, the Moving Average Convergence Divergence (MACD) indicators have turned negative, with the current values reading DIF: -122.4 and DEA: -112.9. This negative divergence in MACD bars, which are continuing to grow, implies an increase in downward momentum and may be indicative of sustained selling pressure that investors need to carefully evaluate. Key support levels come into play as well amid this tumultuous market landscape. Analysts have identified a crucial support level at 2330. Should the asset price breach this level, it could potentially ignite a new phase of declines, heightening the risk involved for those currently holding assets or contemplating entering the market. Investors must be attuned to these dynamics and consider the ramifications of a sustained retreat in prices below significant supports, as failing this could lead to a herd mentality among traders, culminating in heightened market volatility. Amidst the prevailing bearish sentiment, it is imperative for investors to exercise caution. The current market conditions warrant a careful approach that includes waiting for indications of stabilization before making any aggressive moves. Those entrenched in the market may benefit from employing risk management strategies, such as setting stop-loss orders to protect against further downside or diversifying their portfolio to mitigate overall exposure to potential volatility. In summary, the cryptocurrency market is wrestling with pronounced downward trends, marked by increased trading volume and alarming technical indicators. The key factors suggesting potential further declines necessitate prudent decision-making and caution among investors. By navigating through the market with a well-thought-out strategy and a keen eye on technical signals, investors can better position themselves to either safeguard their investments or strategically capitalize on emerging opportunities as the landscape evolves. Staying informed will be essential in these market conditions, as developments can shift rapidly, turning hopeful signals into contributions for deeper market sentiment revisions.

Keywords

Ethereum

Ethereum

2025-02-27

Blockenza Analysis

The analysis indicates a significant bearish trend in the market, influenced by increased selling pressure and negative technical indicators. The projected price movement appears to be downward, warranting caution among investors.

FAQs

1. What is the current market trend?

The market shows a clear downward trend.

2. What was the high price reached on February 23, 2025?

The high price was 2850.

3. What was the closing price on February 26, 2025?

The closing price was 2336.5.

4. How many consecutive days have there been high-volume declines?

There have been three consecutive days of high-volume declines.

5. What are the trading volumes recorded for February 24-26, 2025?

The trading volumes were 17.25, 26.14, and 18.98 BTC.

6. What is a death cross?

A death cross occurs when the short-term moving average crosses below the long-term moving average.

7. What are the values of the moving averages mentioned?

The short-term moving average is 2618.38, and the long-term moving average is 2763.62.

8. What does the negative MACD indicate?

It indicates increased downward momentum.

9. What is the key support level identified in the analysis?

The key support level is 2330.

10. What should investors do in light of the current market conditions?

Investors are advised to remain cautious and look for signs of stabilization.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

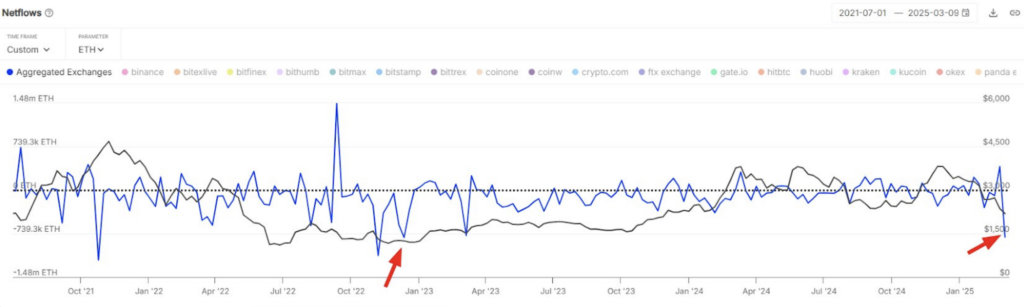

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11