Technical Analysis of Ethereum on March 8, 2025

The market is expected to experience a volatile upward trend from early October to mid-November 2024, followed by a significant decline starting mid-December 2024. Caution is advised, as medium-term risks remain high despite potential short-term rebounds.

Article

### Navigating Market Volatility: Predictions for Late 2024 and Early 2025 As the global financial landscape evolves, investors and traders alike are keenly watching market indicators to navigate the often-turbulent waters of economic trends. Current analyses reveal a volatile upward trend anticipated to commence from early October to mid-November 2024. This anticipated surge is driven by multiple factors, including seasonal buying patterns, investor optimism, and potential economic stimulus measures. However, this upward momentum is expected to be short-lived, giving way to significant downward shifts starting in mid-December, requiring astute market awareness from those engaged in trading and investing. The late-year outlook suggests a troubling transition as the market begins to pivot toward a bearish sentiment. Specifically, as we enter February 2025, this downward trend is projected to pick up speed. Notably, February 3, 2025, is marked as a critical date where technical analysis reveals a large bearish candle forming, signifying a potential panic sell-off among investors. This red flag in market indicators cautions participants about the pervasive risk of an impending decline. Technical indicators such as the Moving Average Convergence Divergence (MACD) and the moving average system are presently showcasing a clear bearish trend. The MACD values illustrate a worrying scenario, with a Difference (DIF) value of -177.07 and a signal line (DEA) value of -161.91. Additionally, the histogram value of -15.16 demonstrates widening bearish momentum, confirming the expectation for declining prices in the near future. In terms of market structure, key resistance levels are identified around 3400 and 3700. When prices approach these regions, they often encounter selling pressure, limiting the potential for further upward movement. Conversely, crucial support levels are identified at 2100 and 2300, serving as critical thresholds where buying interest may stabilize declining prices. However, if these support levels fail to hold, the likelihood of more drastic sell-offs and market corrections increases significantly. Despite the looming risks, some analysts suggest that traders may witness a short-term rebound within the upward trend leading up to November. Such rebounds can sometimes be fueled by speculative trading, economic news, or governmental interventions that stimulate market activity. However, it is essential to recognize that these short-lived rallies may not represent a shift in the underlying bearish sentiment. The medium-term outlook remains riddled with downside risk, urging investors to tread with caution. In light of the anticipated market fluctuations, it would be wise for traders and investors to adopt a conservative approach. Comprehensive risk management strategies, including setting stop-loss orders and diversifying portfolios, can help mitigate potential losses amid expected volatility. By staying informed about macroeconomic indicators and corporate earnings reports, investors can better position themselves against sudden market movements. In conclusion, while the market pattern suggests a volatile upward trend from early October to mid-November 2024, the subsequent bearish phase beginning in mid-December signals a critical need for caution. As February 2025 approaches, potential sell-offs and declines necessitate a recalibration of investment strategies. Staying vigilant, utilizing technical analysis for informed decision-making, and implementing appropriate risk management practices will be crucial. With careful planning, investors can navigate the uncertainties of the market and protect their investments from the anticipated ebb and flow of economic conditions.

Keywords

Ethereum

Ethereum

2025-03-08

Blockenza Analysis

The analysis indicates a bearish outlook for Ethereum, suggesting the price will decline due to significant market challenges and technical indicators pointing to weakness.

FAQs

1. What is the expected market trend from October to November 2024?

A volatile upward trend is expected during this period.

2. When is the downward trend forecasted to start?

The downward trend is anticipated to begin in mid-December 2024.

3. What significant event is predicted on February 3, 2025?

A large bearish candle indicating a panic sell-off is predicted.

4. What are the key resistance levels?

The key resistance levels are around 3400 and 3700.

5. What are the key support levels?

The key support levels are around 2100 and 2300.

6. What do the MACD and moving average system indicate?

Both indicators suggest a bearish trend.

7. What are the DIF, DEA, and histogram values related to?

These values indicate the strength of the bearish trend.

8. Is there potential for a rebound in the short term?

Yes, there may be a short-term rebound.

9. What is the recommendation for traders in this market?

Traders are advised to operate cautiously due to the high medium-term downside risk.

10. How significant is the downside risk for Ethereum?

The medium-term downside risk is considered relatively high.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Fundamental Analysis of Ethereum on March 11, 2025

The cryptocurrency market experienced notable volatility from October 2024 to March 2025, characterized by a breakout pattern leading to an initial bullish trend before a sharp downturn occurred. Despite warnings indicated by technical indicators of bearish momentum, recent developments suggest caution as market participants monitor trading volumes and support levels for potential recovery opportunities.

Ethereum

Ethereum

2025-03-11

A Whale Purchased 15,292 ETH for an Average Price of $2014

A whale purchased 15,292 ETH for an average price of $2014 about ten hours ago, currently facing an unrealized loss of $2.2 million due to market fluctuations. This scenario underscores the volatility and risk associated with investing in cryptocurrencies.

Ethereum

Ethereum

2025-03-11

Promising Altcoins to Invest in for Your 2025 Portfolio: Web3Bay, Solana, XRP, Hedera, & Sui

As the cryptocurrency market enters a new growth phase, 2025 will likely highlight altcoins with high return potential. Investors are advised to explore a diverse range of altcoins beyond Bitcoin and Ethereum for promising investment opportunities.

Ethereum

Ethereum

2025-03-11

Ethereum's Decline: A Significant Drop Amid Market Challenges

Ethereum has fallen to $1,809, experiencing an 8% decline over the last day, with the BTC/ETH ratio dropping below 0.24 for the first time since February 2020. The cryptocurrency market remains volatile as investors keep a watchful eye on these developments.

Ethereum

Ethereum

2025-03-11

Unstoppable Crypto Access: Coinbase Launches Revolutionary 24/7 Bitcoin and Ethereum Futures

Coinbase has announced the launch of 24/7 Bitcoin and Ethereum futures, revolutionizing market access for U.S. traders. This groundbreaking move enables traders to engage with cryptocurrencies around the clock, attracting both seasoned and new investors.

Ethereum

Ethereum

2025-03-11

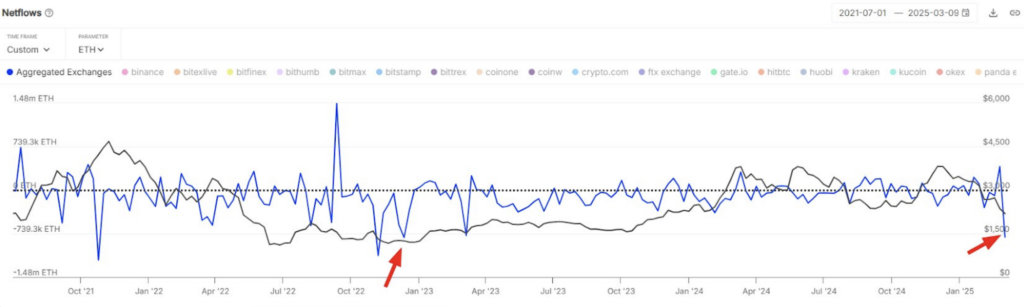

Ethereum Price Bottom? $1.8 Billion in ETH Outflow Fuels Market Speculation

Ethereum (ETH) saw its largest weekly exchange outflow of $1.8 billion since December 2022, suggesting accumulation among investors despite ongoing bearish sentiment. However, technical indicators indicate a critical resistance level that needs to be reclaimed for a confirmed price bottom.

Ethereum

Ethereum

2025-03-11