Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Article

Chainlink, a decentralized oracle network founded by Sergey Nazarov, is positioned to become a transformative player in the financial landscape as traditional financial systems increasingly adopt blockchain technology. Nazarov estimates that the market value of Chainlink could skyrocket to an astonishing $350 trillion, highlighting the immense potential that this innovation holds for reshaping the infrastructure of financial transactions and services. To facilitate this transition, Chainlink has formed a strategic partnership with SWIFT, the global leader in financial messaging services. This collaboration seeks to harness the benefits of blockchain technology and ensure seamless integration into the existing financial architecture. By conducting trial programs with banking leaders worldwide, SWIFT and Chainlink aim to enhance the application of blockchain, thereby paving the way for the adoption of regulated assets directly on blockchain systems. The significance of the financial sector for Chainlink cannot be overstated. SWIFT manages a staggering $150 trillion in transactions each year, making it a critical player for any effort aimed at revolutionizing the financial landscape through technology. Nazarov's advocacy for collaboration between blockchain and traditional finance is reflected in the growing involvement with major financial institutions, including a notable partnership with UBS. This collaboration not only positions Chainlink advantageously within the financial ecosystem but also serves as a strong indicator of rising institutional interest in blockchain solutions. Despite facing a significant price decline since December 2022, during which Chainlink's (LINK) token value dropped substantially, the outlook remains cautiously optimistic. Understandably, the cryptocurrency market as a whole is undergoing a correction phase, impacting many digital assets. However, Chainlink's focus on sectors with high transaction volumes, like finance, ensures that its long-term prospects are promising. Institutional interest has started to develop as well, exemplified by U.S. government-linked wallets that presently hold over 100,000 LINK tokens. In fact, the correlation of Chainlink with governmental and institutional players fortifies its position as a pivotal technology for the financial sector. It is particularly worth noting that the U.S. government holds approximately $1.7 million in LINK tokens, signaling a degree of endorsement of Chainlink’s technological capabilities. Such backing adds a layer of credibility that could catalyze wider adoption across both public and private sector entities. Chainlink's potential for value appreciation remains compelling. After experiencing a downturn, the token’s price is currently at a modest $5.25, yet historical patterns suggest a favorable long-term trajectory. If Chainlink breaks the next resistance barrier, it might see a surge toward $31, which would represent a potential market appreciation of up to 120%. This is especially feasible unless the token's value falls below critical support levels. Looking ahead, the engagement from traditional financial institutions, participation in pilot launches, and strategic collaborations all signify that Chainlink is on a promising path. The advent of trials with SWIFT represents a crucial step forward in bridging the gap between conventional finance and blockchain-based systems. As these efforts unfold, it seems likely that Chainlink will not only solidify its position in the market but also play a critical role in the broader acceptance of blockchain technology within traditional finance. In summary, as the financial world eagerly anticipates how blockchain will revolutionize transactions and contracts, Chainlink stands at the forefront, ready to lead the charge into a new era of financial innovation. The combination of strategic partnerships, financial backing, and market potential creates an optimistic narrative for Chainlink in the upcoming years.

Keywords

Chainlink

Chainlink

2025-03-11

Blockenza Analysis

Chainlink shows signs of potential recovery based on historical price patterns and upcoming collaborations, indicating a bullish outlook unless price falls below critical support levels.

FAQs

1. What is Sergey Nazarov's prediction for Chainlink's market value?

He predicts it could reach $350 trillion with blockchain integration into traditional financial systems.

2. What collaboration is Chainlink undertaking with SWIFT?

They are working together to enhance blockchain usage in banking through trial programs.

3. How many LINK tokens are held by U.S. government-linked wallets?

They currently control over 100,000 LINK tokens.

4. What has happened to Chainlink's price since December 2022?

It has experienced a steep drop during a general correction phase in the cryptocurrency market.

5. What is the potential for Chainlink despite recent price drops?

There is long-term growth potential due to its focus on financial markets and upcoming collaborations.

6. When is the next trial for Chainlink with SWIFT scheduled?

The vendor system test will take place on May 2, with a pilot launch on July 19.

7. Who are some of the institutional adopters of Chainlink?

UBS is mentioned as one of the major banking institutions participating.

8. What signifies a potential price increase for Chainlink?

The price structure suggests an upcoming upward movement, potentially reaching $31.

9. What could threaten Chainlink's price outlook?

A drop below the support level of $5.25 could jeopardize its upward trajectory.

10. What overarching structure does the price of Chainlink currently exhibit?

It shows a bullish megaphone pattern with diverging trend lines.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

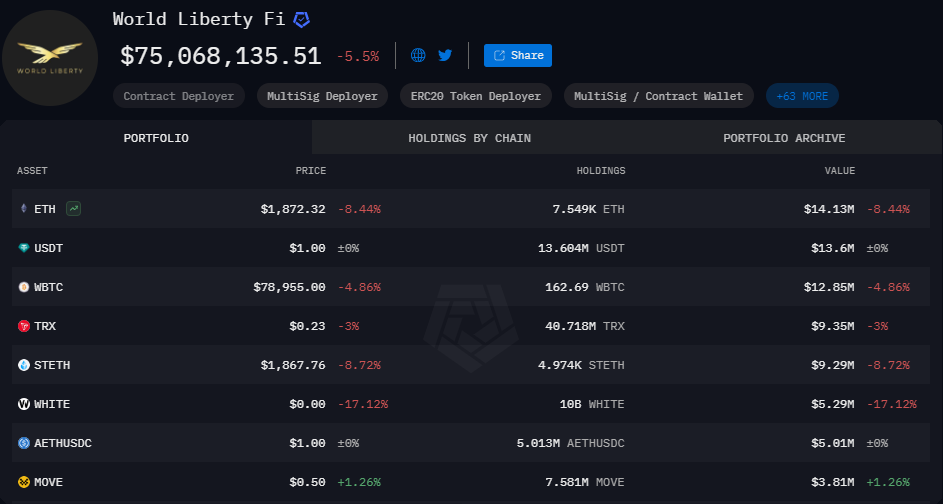

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11