Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Article

The financial landscape is evolving at a rapid pace, and one of the most striking developments in recent months has been the remarkable surge in the total market capitalization of the top five stablecoins, which has soared to an impressive $204.7 billion. This group includes prominent names such as Tether (USDT), USD Coin (USDC), USDS, Ethena’s USDe, and DAI. The ascent in their market values is indicative of a profound shift in investor behavior, revealing a clear movement away from high-risk investments towards more stable, cash-like instruments. In a climate characterized by economic uncertainty and volatility, many investors are increasingly seeking refuge in stablecoins. These digital currencies are pegged to traditional fiat currencies, often the US dollar, providing a level of stability that is appealing in these tumultuous times. The surge also reflects a growing trend of risk aversion among market participants, who are understandably cautious about putting their money in more traditional venture capital, stocks, or even cryptocurrencies that are known for their price fluctuations. What makes this trend particularly noteworthy is the paradox presented by the rise of stablecoins against a backdrop of broader cryptocurrency market volatility. While many digital assets like Bitcoin and Ethereum experience dramatic price swings, stablecoins effectively function as a safe haven, allowing investors to park their funds without exposing themselves to the same levels of risk associated with their more volatile counterparts. This dynamic is pushing many to re-evaluate their investment strategies as they emphasize security and liquidity. The impressive growth in the market capitalization of these stablecoins also highlights their increasing acceptance within the financial community. Institutional and retail investors alike are beginning to acknowledge the potential of blockchain-based financial instruments as a viable alternative to traditional banking systems. Stablecoins act as a bridge between the crypto world and conventional finance, facilitating transactions in a seamless and low-cost manner. Moreover, prominent cryptocurrencies like Tether (USDT) and USD Coin (USDC) are increasingly being integrated within various decentralized finance (DeFi) platforms, further enhancing their utility. The DeFi space relies heavily on stablecoins to enable lending, borrowing, and trading activities without the uncertainty associated with price volatility. This integration expands the role of stablecoins, not only as a means of preserving capital but also as essential components of the growing crypto ecosystem. This shift towards stablecoins also poses interesting implications for monetary policy and regulatory frameworks. As stablecoins become robust components of the financial landscape, regulators worldwide are grappling with how to address the challenges and opportunities they present. The need for regulatory clarity is escalating, with discussions centered on consumer protection, financial stability, and the potential for these instruments to disrupt traditional banking. In conclusion, the impressive market capitalization of the top five stablecoins marks a significant milestone in the cryptocurrency universe, reflecting a broader trend of risk aversion among investors. The increasing focus on safety and liquidity indicates a shift in investor preferences, underscoring the transformative role stablecoins play in both the crypto ecosystem and the global financial landscape. As more participants prioritize security and the preservation of capital, it is likely that stablecoins will continue to gain traction, shaping the future of digital finance and potentially influencing monetary policy in the years to come.

Keywords

Chainlink

Chainlink

2025-03-11

Blockenza Analysis

Given the increase in stablecoin market capitalization and the observed trend of risk aversion among investors, the overall sentiment leans towards market stability rather than aggressive growth. However, the shift towards safer assets indicates a cautionary approach that could lead to a temporary downturn in other riskier crypto assets.

FAQs

1. What is the total market capitalization of the top five stablecoins?

$204.7 billion.

2. Which stablecoins are included in the top five?

Tether (USDT), USD Coin (USDC), USDS, Ethena’s USDe, and DAI.

3. What does the increase in stablecoin market value signify?

It signifies a shift from riskier assets to cash-like instruments.

4. What does a trend towards risk aversion mean for investors?

It indicates that investors are seeking more secure investment options.

5. Why are stablecoins gaining popularity?

Because they provide stability and security in volatile markets.

6. How does investor behavior impact stablecoin market capitalization?

Shifts in investor behavior towards safety increase the demand for stablecoins.

7. What role do stablecoins play in the cryptocurrency ecosystem?

They act as a refuge during market volatility and help preserve capital.

8. What does the article suggest about the evolving landscape of digital assets?

It suggests that investor preferences are changing in response to market conditions.

9. Is there growing acceptance of crypto-based financial instruments?

Yes, there's a noticeable increase in reliance on such instruments.

10. What is the significance of a $204.7 billion market cap for stablecoins?

It reflects a historic growth milestone and investor confidence in stablecoins.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

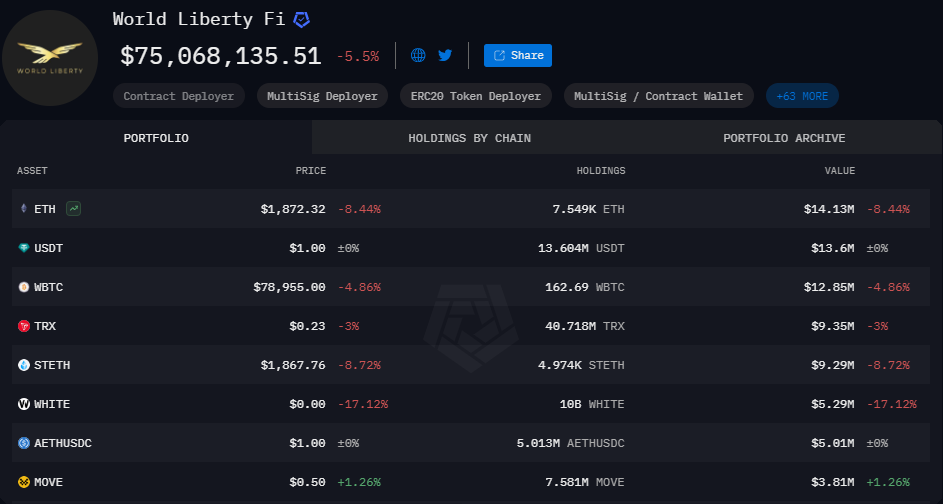

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11