Fundamental Analysis of Chainlink on March 11, 2025

The cryptocurrency market is facing a challenging downward trend, with investors watching key resistance and support levels to determine future price movements. While bearish sentiment dominates, a potential short-term rebound may arise if certain thresholds are breached.

Article

The cryptocurrency market, known for its dynamic nature and rapid fluctuations, is presently navigating through a challenging bearish trend. This downward shift has created an atmosphere thick with volatility and uncertainty, leaving many investors and traders on edge as they reconsider their strategies in light of changing market conditions. However, amidst this bearish sentiment, indications of a potential short-term rebound may lie ahead. Understanding key resistance and support levels becomes crucial in this setting, as they serve as essential indicators for future market movements and provide invaluable insights for traders as they devise their strategies. Currently, the notable resistance level sits around the price mark of 20. Traders are keeping a watchful eye on this barrier because a breakout above this threshold could usher in renewed bullish sentiment, potentially driving prices upward. Market participants often use resistance levels as psychological benchmarks; therefore, a breach above these levels might also encourage more investors to enter the market, seeking to capitalize on a perceived uptick in momentum. Conversely, the support level is pegged at approximately 18. This level acts as a safety net against further declines. The strength of support levels often reflects the buying power at these price points, and if prices fall below the 18 mark, it could trigger a cascade of bearish momentum. Traders are particularly attuned to this possibility, as slipping past this support could lead to prices plummeting to around 15, thereby causing significant losses for those caught off guard. Analyzing technical indicators such as the Moving Average Convergence Divergence (MACD) sheds light on market dynamics. The MACD is a valuable tool for traders, as it helps in identifying shifts in momentum. Currently, the MACD suggests that while bearish momentum may be waning, a definitive reversal signal is yet to present itself. This aspect indicates that traders should remain on high alert as market trends can shift swiftly and unexpectedly. Furthermore, trading volume has also seen notable increases. On December 2, 2024, trading volume soared to 601,807 coins, illustrating the high level of interest and activity within the market. Increased trading volume often accompanies significant price fluctuations, raising the stakes for traders and necessitating vigilant caution. In a market characterized by sudden price swings, understanding volume trends can often provide clues to future price movements. The current landscape, marked by a short-term moving average sitting below the long-term moving average, indicates a bearish crossover, which raises red flags for vigilant traders trying to safeguard their investments. As market sentiment remains fickle, it is essential for traders to keep a sharp focus on both resistance and support levels, as well as any signals provided by the MACD. Despite the ongoing bearish trend, opportunities may lie ahead for cautious investors willing to exercise patience. In this ever-evolving cryptocurrency landscape, it is paramount to adhere to informed strategies, remain disciplined, and avoid impulsive decisions. Implementing a strategic approach will allow traders to navigate the complexities of the market, identify potential rebounds, and position themselves for future market movements. In conclusion, while the current downturn may evoke a sense of trepidation within the cryptocurrency community, the potential for recovery is always in play. Continual monitoring of price levels and technical indicators will be essential for traders seeking to harness market volatility while mitigating risks. With a careful approach to trading, equipped with the right tools and knowledge, investors may find opportunities even in the most challenging of times.

Keywords

Chainlink

Chainlink

2025-03-11

Blockenza Analysis

The analysis indicates a bearish sentiment in the cryptocurrency market with a significant risk of further declines, hence a score of -60.

FAQs

1. What is the current trend in the cryptocurrency market?

The cryptocurrency market is currently experiencing a downward trend.

2. What are the key resistance and support levels?

The resistance level is around 20, and the support level is approximately 18.

3. What does increased trading volume indicate?

Increased trading volume signifies significant price fluctuations and potential volatility.

4. What does the MACD indicator show?

The MACD indicator shows that bearish momentum is weakening, but a clear reversal signal has yet to appear.

5. What is a bearish crossover?

A bearish crossover occurs when the short-term moving average is below the long-term moving average, indicating a downtrend.

6. How should traders respond to market volatility?

Traders should monitor resistance and support levels closely and adhere to informed trading strategies.

7. What is bottom-fishing in trading?

Bottom-fishing refers to trying to buy at perceived lows in hopes of a price rebound.

8. What is the significance of resistance and support levels?

Resistance levels indicate price points where selling may exceed buying, while support levels indicate where buying may overwhelm selling.

9. How can investors manage risks in the cryptocurrency market?

Investors can manage risks by setting stop-loss orders and maintaining a diversified portfolio.

10. What is the potential for price recovery in the next few days?

The potential for price recovery exists if the resistance level at 20 is breached.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

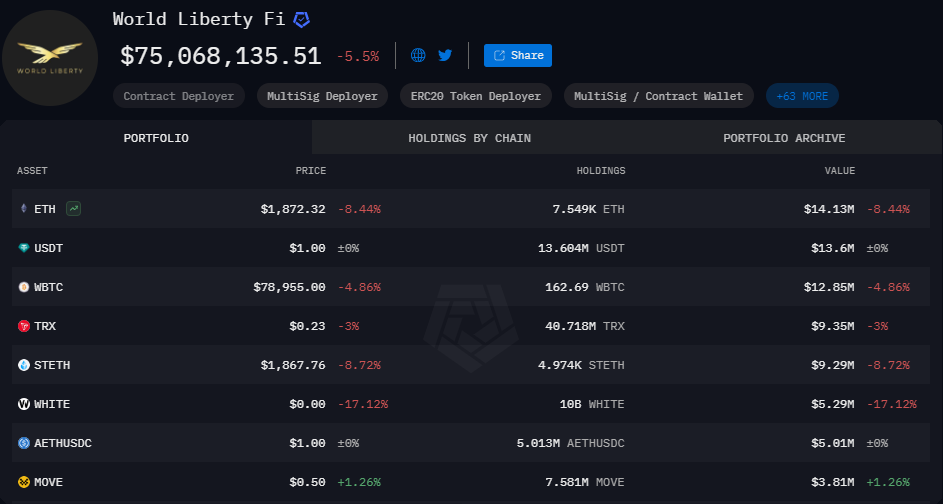

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11