Fundamental Analysis of Chainlink on March 3, 2025

The cryptocurrency market is currently facing a bearish trend influenced by indicators such as the death cross and bearish MACD signals, raising concerns about potential further declines. Investors should focus on key support and resistance levels to navigate this volatile environment effectively.

Article

**Navigating the Stormy Seas of Cryptocurrency: Current Market Insights and Outlook** Cryptocurrencies, celebrated for their potential to disrupt traditional financial systems, are equally notorious for their unpredictable volatility. As the digital currency landscape continues to evolve, it is crucial to grasp the intricacies of the market, especially during bearish trends that tend to unsettle investors. Presently, a specific cryptocurrency illustrates such volatility, revealing an evident downward spiral amid current market conditions. Recent analyses of price charts reveal a striking downturn that has unfolded since mid to late February 2025 (UTC), which exemplifies the erratic nature of cryptocurrencies. This downturn is not just a mere fluctuation; it is often accompanied by increasing trading volumes, suggesting a surge in investor activity. This uptick could stem from aggressive asset liquidations or efforts by traders to capitalize on the anticipated price declines, a common strategy employed in bearish markets. A pivotal technical indicator contributing to the adverse sentiment is the emergence of a "death cross." This term refers to a scenario in which a short-term moving average dips below a long-term moving average, typically portrayed as a bearish signal. When this crossover occurs, traders often brace themselves for sustained negative momentum. In conjunction with this, the Moving Average Convergence Divergence (MACD) signals a strong bearish inclination, reinforcing expectations that prices may continue on a downward trajectory in the near term. Navigating the volatile cryptocurrency markets necessitates astute awareness of key support and resistance levels that serve as psychological barriers for traders. Presently, the cryptocurrency is approaching an initial support level around 14,000, making its robustness a point of concern. Should the price breach this vital threshold, it could trigger a cascade of additional selling pressure. A more potent support level reveals itself around 10,347, where heightened buying interest may counteract the prevailing selling momentum. Observing these levels provides invaluable insights into potential price reversals or further declines. On the horizon, we find immediate resistance positioned at 19,000; should the price surpass this barrier, it could catalyze a positive shift in market sentiment. Further complicating the outlook, a significant resistance level appears near 27,000, a price range that may remain elusive unless we witness substantial changes in market dynamics or favorable developments, such as regulatory clarity or institutional adoption of cryptocurrencies. Despite the prevailing bearish narrative, an emerging pattern is noteworthy for astute investors. An observed long lower wick on price charts dated February 24 (UTC) indicates some purchasing interest at lower price points. This suggests that even in a downturn, there are pockets of buying interest that could hint at stabilization attempts. Nonetheless, such movements are often ineffective in reversing an entrenched bearish trend without sustained purchasing vigor. As we analyze the current landscape, investors must balance caution with strategic investment opportunities. While bearish momentum undeniably persists, potential market rebounds may emerge due to oversold conditions, offering knowledgeable traders opportunities to buy at lower prices in anticipation of price recoveries in the future. In summary, the prevailing data for this specific cryptocurrency undoubtedly underscores a bearish trend amplified by technical signals like the death cross and bearish MACD. As the market undergoes dramatic shifts, traders and investors must maintain vigilance, carefully monitoring significant support and resistance levels while being on the lookout for signs of potential reversals. Grasping these elements provides crucial insights that empower investors to navigate the ever-changing cryptocurrency market with agility and foresight. In a world where every trend can turn on a dime, knowledge and adaptability remain your best strategies for survival and success.

Keywords

Chainlink

Chainlink

2025-03-03

Blockenza Analysis

The current bearish trend and the presence of negative technical indicators suggest that the price of the cryptocurrency is likely to decline further.

FAQs

1. What is the current trend of the cryptocurrency?

The current trend is bearish.

2. What is a death cross?

A death cross occurs when a short-term moving average crosses below a long-term moving average, indicating potential bearish momentum.

3. What levels should investors monitor?

Investors should keep an eye on key support levels around 14,000 and 10,347, as well as resistance levels around 19,000 and 27,000.

4. What does increased trading volume indicate?

Increased trading volume often signals heightened investor activity, either in selling assets or attempting to buy at lower prices.

5. What is the MACD indicator suggesting?

The MACD is reflecting bearish tendencies, indicating further downward price momentum.

6. What occurred on February 24 on the price chart?

A long lower wick appeared, indicating some buy-side interest, but it did not significantly change the bearish trend.

7. Why are support levels important?

Support levels are crucial as breaks below them often lead to further declines in price.

8. What opportunities can arise in a bearish market?

Oversold conditions may create chances for price corrections, allowing investors to buy at lower prices.

9. How do localized buying efforts affect the market?

Localized buying efforts can stabilize the price temporarily but often need sustained buying pressure to reverse a trend.

10. What does the overall market sentiment indicate?

The overall sentiment indicates the potential for continued downward movement in the near future.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

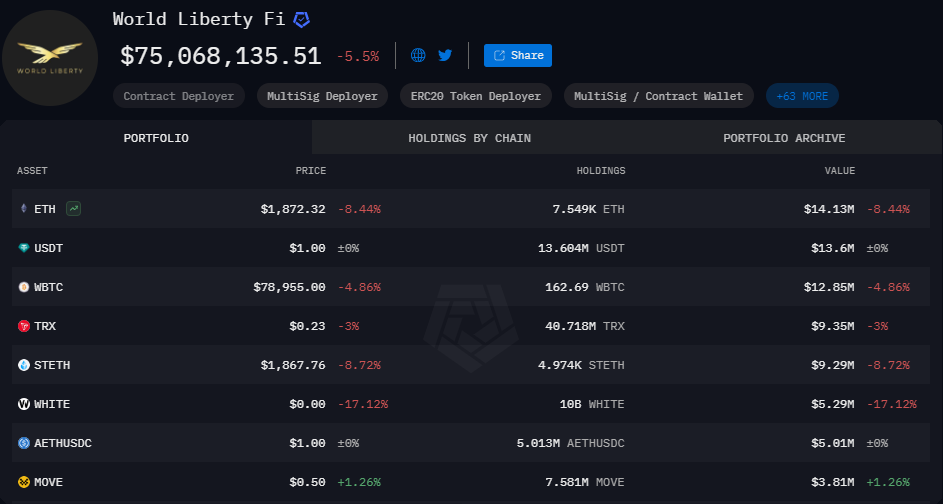

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11