Fundamental Analysis of Chainlink on March 4, 2025

The cryptocurrency market's volatility necessitates investors to closely analyze projected trends, which indicate price increases for a specific cryptocurrency from October to mid-November 2024, followed by a period of corrective volatility into early 2025. Key resistance and support levels will define trading opportunities and risks, urging investors to adopt proactive strategies to manage potential downturns.

Article

The cryptocurrency market is an arena renowned for its inherent volatility and unpredictability, making it an exciting yet precarious investment landscape. Investors and enthusiasts must keep a close watch on emerging trends to navigate this complex environment successfully. As we look ahead, a meticulous analysis of projected trends for certain cryptocurrencies suggests a promising window beginning in early October 2024, extending through mid-November 2024. This period is particularly poised for price gains, providing stakeholders with a lucrative opportunity to leverage the anticipated market movements. The bullish investor sentiment expected during this timeframe will likely be bolstered by a confluence of external elements, including heightened market demand, technological breakthroughs, positive regulatory news, and macroeconomic conditions that favor digital asset investments. Ignited by these catalysts, many investors might find this period ripe for capitalizing on potential gains. However, it is essential to temper expectations around these projected price rallies; while speculative forecasts hint at significant increases, history has shown that such trends can be ephemeral. After this growth period, cryptocurrency markets are expected to transition into an adjustment phase characterized by greater volatility spanning from December 2024 to January 2025. This cyclical phase is customary in the cryptocurrency realm, often triggered by heightened speculative interest that inevitably leads to market corrections. Therefore, traders and investors should prepare themselves for fluctuating prices as the market seeks a more sustainable growth trajectory. It's important to identify potential resistance levels—specific price points where selling pressure could intensify and thwart upward momentum. Notably, anticipated resistance includes $26.90 (UTC) on December 2, 2024; $30.89 (UTC) on December 13, 2024; $27.17 (UTC) on January 22, 2025; and $26.37 (UTC) on January 31, 2025. These key resistance markers will likely play a crucial role in influencing future price trajectories, as they may act as psychological barriers to continued growth. As we head into 2025, the market may face additional psychological challenges that could inhibit further price increases. Key support levels will also warrant attention, particularly as they signify points of potential breakdown. Significant support levels include $14.01 (UTC) on February 25, 2025; $13.47 (UTC) on February 28, 2025; and $14.23 (UTC) on March 1, 2025. There is a risk that these levels could be breached during a steep anticipated decline in February 2025, which may subject the market to intense selling pressure. Nonetheless, a minor rebound could be on the horizon for early March 2025. Even so, the overall market sentiment is forecasted to remain weak, highlighting the need for cautious navigation by savvy investors. In light of potential fluctuations, the significance of robust risk management strategies cannot be overstated. Employing tools such as stop-loss orders and diversifying investment portfolios will be essential in shielding against unpredictable market shifts. The cryptocurrency realm is marked by rapid changes and periodic shocks, creating both perilous and rewarding investment opportunities. For anyone looking to thrive in this dynamic domain, close attention to price movements, market sentiment, and external influences is crucial. Informed decision-making will empower investors to adapt and respond adeptly to shifts within this ever-evolving market landscape. As we anticipate these future developments, the ability to remain vigilant and proactive can define success in the unpredictable world of cryptocurrencies.

Keywords

Chainlink

Chainlink

2025-03-04

Blockenza Analysis

The analysis indicates an overall bearish trend with substantial risks of price declines due to current market conditions and technical indicators.

FAQs

1. When is the favorable period for the cryptocurrency?

The favorable period is expected to begin in early October 2024 and extend through mid-November 2024.

2. What factors influence investor sentiment during this period?

Investor sentiment is influenced by market demand, technological advancements, regulatory updates, and supportive macroeconomic circumstances.

3. What happens after the promising phase of growth?

The cryptocurrency enters a period of adjustment characterized by heightened volatility from December 2024 through January 2025.

4. What are the notable resistance levels for the cryptocurrency?

Resistance levels include $26.90 on December 2, 2024, $30.89 on December 13, 2024, $27.17 on January 22, 2025, and $26.37 on January 31, 2025.

5. What support levels should investors monitor in early 2025?

Key support levels are $14.01 on February 25, 2025; $13.47 on February 28, 2025; and $14.23 on March 1, 2025.

6. What risks are associated with the anticipated downturn?

There is a risk that support levels may be breached, leading to further downward pressure on the price.

7. What strategies should investors employ in this market?

Investors should implement risk management strategies, including setting stop-loss orders and diversifying their investment portfolios.

8. What signals indicate a bearish trend in the market?

Technical indicators like the 'death cross' and bearish MACD signals suggest a sustained negative momentum.

9. Is there potential for price rebounds in early 2025?

A minor rebound is expected in early March 2025, although the overall trend remains weak.

10. What must investors watch for in the unpredictable crypto landscape?

Investors must keep an eye on price movements, market sentiment, and external factors influencing cryptocurrency prices.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

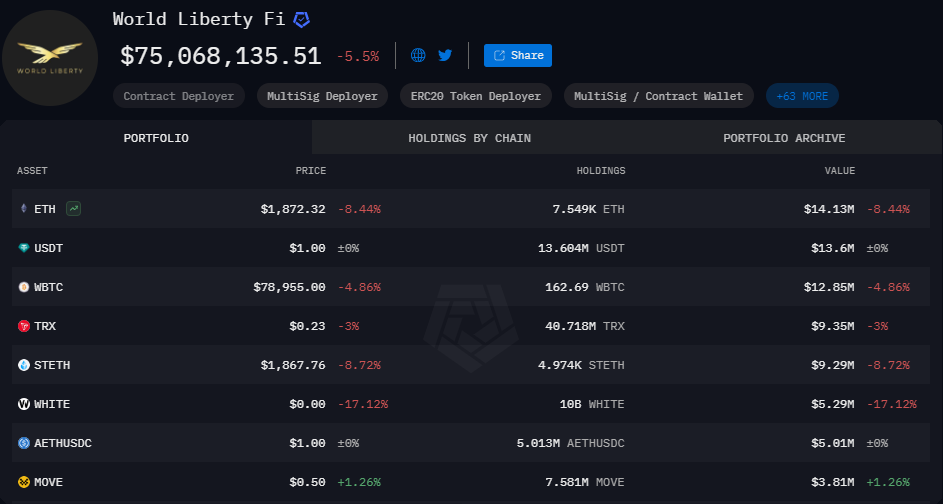

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11