Fundamental Analysis of Chainlink on March 7, 2025

The cryptocurrency market has seen a significant downward trend from October 2024 to March 2025, with key resistance and support levels impacting trading decisions. Current market sentiment remains cautious, as investors carefully monitor trading volumes and price movements in preparation for potential fluctuations.

Article

Market trends serve as essential indicators for investors and traders, acting as bellwethers that offer crucial insights into the movements of various trading assets over specified time frames. Observing the market developments between early October 2024 and early March 2025 reveals a significant downward trajectory that captures the attention of market participants. This tumultuous phase was marked by an initial attempt to rebound from a consecutive decline in early to mid-November 2024; however, this effort faltered under the weight of relentless selling pressure, underscoring the need for a deeper analysis of market mechanics. A close examination of technical analysis principles reveals key indicators like trading volume, price patterns, and market sentiment as indispensable tools for investors wishing to navigate turbulent waters. Resistance levels at $27.41 and $30.89 established a psychological ceiling, beyond which selling activity may intensify, thwarting attempts at price appreciation. Meanwhile, lower support levels at $14.01 and $13.09 represented crucial price points where bullish inflows could emerge, indicating potential buying opportunities should the market reverse direction. One notable date in this period was December 2, 2024, when the market witnessed a sudden spike in trading volume, with 601,807 coins changing hands. This surge coincided with a brief uptick in prices, hinting at a temporary resurgence in buying interest potentially influenced by speculation or significant news events. However, this fleeting enthusiasm did little to shift the overall trajectory, as the market's prevailing pessimistic mood quickly dissipated. Entering mid-January 2025, the market flashed a cautionary signal indicative of bearish sentiment: the formation of a "death cross" within the short-term moving averages. Recognized as a bearish indicator, a death cross materializes when a short-term moving average crosses below a long-term moving average, suggesting waning market momentum and foreshadowing possible further declines. Additionally, the Moving Average Convergence Divergence (MACD) indicator reinforced this somber outlook by indicating increasing bearish strength, giving rise to further concerns about impending market volatility. The prevailing sentiment found in trading volumes reflected caution among participants; such low trading activity can trigger additional market fluctuations, instilling skittishness among traders hesitant to take on riskier investments. This troubling trend necessitates scrutiny; even minor catalysts can instigate significant fluctuations in asset prices, warranting vigilance from market stakeholders. As we look towards the future, market sentiment anticipates continued short-term declines. Investors are advised to maintain close watch for potential stabilization or reversal signals within the market environment. To successfully navigate this complex landscape, reliance on technical indicators, price patterns, and trading volumes is critical. Moreover, prudent diversification of investment portfolios and robust risk management strategies will be essential for weathering challenges in the uncertain market ahead. The decline observed during this time highlights the importance of diligent analysis and strategic foresight for investors and traders alike. As prices approach critical support levels, market participants are poised for action, ready to respond to any indications of a rebound or further downturn. Ultimately, the trajectory of financial markets from early October to early March encapsulates a delicate balance between burgeoning optimism and underlying pessimism. The initial surge of investor confidence was ultimately stifled by skepticism, accentuating the importance of ongoing assessments and adaptability among market participants. Traders who remain keenly aware of changing dynamics and adeptly glean insights from market behavior will find themselves better positioned to navigate the ever-evolving financial landscape.

Keywords

Chainlink

Chainlink

2025-03-07

Blockenza Analysis

The current trends suggest a continuation of the bearish sentiment in the cryptocurrency market, indicating that prices are likely to fall further. Market conditions are volatile and would require cautious trading strategies.

FAQs

1. What were the market trends from October 2024 to March 2025?

The market experienced a pronounced decline characteristic of bearish sentiment and notable fluctuations.

2. What is a death cross?

A death cross occurs when a short-term moving average crosses below a long-term moving average, signaling potential further price declines.

3. What are important resistance levels for cryptocurrency?

Significant resistance levels have been identified at $26.90 and $30.89.

4. What are crucial support levels for the market?

Crucial support levels are found at $14.01 and $13.09, where buying interest may increase.

5. What does low trading volume signify?

Low trading volume reflects cautious sentiment and can trigger further volatility in the market.

6. What is the significance of the upper wick in price patterns?

An upper wick indicates a failed attempt to sustain higher prices, suggesting that bullish sentiment may be waning.

7. What can traders anticipate in the near term?

Traders should prepare for continued fluctuations and possible consolidation phases in the market.

8. What role do technical indicators play in trading?

Technical indicators help traders analyze market movements, price trends, and potential signals for entry or exit.

9. How should investors navigate the current market environment?

Investors should maintain vigilance and rely on thorough analysis, diversification, and risk management strategies.

10. What should investors do as prices test support levels?

Investors should stay alert for signs of stabilization or further declines in asset prices.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

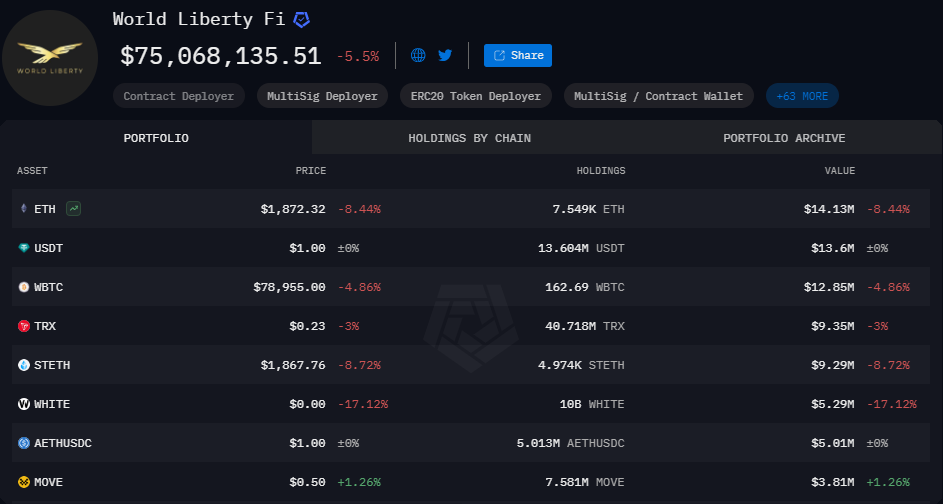

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11