Technical Analysis of Chainlink as of February 28, 2025

The market is on a downward trend, with essential support around 15.07 (UTC). Traders should avoid bottom-fishing and instead observe key dates in February 2025 for potential market movements.

Article

**Market Analysis: Navigating the Current Downtrend** The current market landscape is characterized by a persistent downward trend, a situation that is underscored not only by the prevailing chart patterns but also various technical indicators that reflect growing investor caution. Over recent weeks, although there have been some intermittent rebounds, these movements appear to be short-lived, reinforcing the notion that a more significant downtrend is underway and likely to continue for the foreseeable future. A critical support level has emerged around 15.07 (UTC), marking a crucial threshold for market stability. Should this support level be breached, it’s crucial to understand that this could catalyze a more rapid decline—potentially leading to a sell-off as panic might set in among traders and investors. Severe breaches of support levels often create a cascading effect, where additional selling pressure mounts as bearish sentiment fuels further declines. Hence, maintaining vigilance around this critical marker is essential for any participant in the market. On the flip side, the resistance levels present in the market appear notably weak. This scenario indicates that any potential rebound attempts are likely to be limited in scope and duration. Traders seeking short-term gains may find themselves at risk of falling into traps set by fleeting rallies that lack the strength necessary to sustain upward momentum against prevailing bearish pressures. Furthermore, an analysis of trading volumes reveals a significant decline, which typically reflects a lack of market participation. This inertia indicates that many traders are adopting a more cautious stance, possibly waiting for clearer signals or indicators before committing further capital. A low trading volume often correlates with increased volatility, making market conditions even more unpredictable. And in a bear market, such conditions can translate into sharp price movements in either direction, thus amplifying risk for those involved. From a technical analysis perspective, the formation of what is referred to as a "death cross" in the short-term moving averages underscores the bearish sentiment that has come to dominate market psychology. A death cross occurs when a short-term moving average crosses below a long-term moving average, signaling a potential shift towards sustained downtrends. In tandem with this, the Moving Average Convergence Divergence (MACD) indicator also displays a bearish configuration, with both indicators pointing toward continued bearish pressures and the possibility of further downside in the near term. In light of these evaluations, it becomes clear that engaging in bottom-fishing—the strategy of attempting to purchase stocks or assets at low prices in anticipation of a market reversal—may be ill-advised in the short run. Instead, a more prudent approach for traders and investors alike would be to remain observant and cautious, carefully analyzing the unfolding market dynamics before making any decisions. Given the heightened volatility and uncertainties, traders should be particularly alert to specific critical time points that could catalyze market movements. Key dates to watch in February 2025 include February 5 (UTC), February 4 (UTC), February 18 (UTC), February 17 (UTC), and February 24 (UTC). These dates could signify pivotal moments for market activities, driven by important economic announcements, earnings reports, or geopolitical events that may influence investor sentiment. In conclusion, as we navigate these turbulent market waters, the importance of patience, vigilance, and adherence to sound trading principles cannot be overstated. By keeping a close watch on forthcoming signals and maintaining a disciplined approach, traders stand a better chance of weathering the current downtrend while preparing for potential opportunities when market conditions eventually stabilize.

Keywords

Chainlink

Chainlink

2025-02-28

Blockenza Analysis

Given the continuous downward trend, shrinking trading volume, and bearish indicators, it is anticipated that the price will continue to fall.

FAQs

1. What is the current trend of the market?

The market is experiencing a downward trend.

2. What is the key support level mentioned?

The key support level is around 15.07 (UTC).

3. What happens if the support level is broken?

If it breaks through, the decline may accelerate.

4. Is there potential for rebounding?

The resistance level is weak, limiting any rebound space.

5. What does the trading volume indicate?

Trading volume has shrunk, indicating low market participation.

6. What technical indicators suggest future movement?

Short-term moving averages have formed a death cross, and the MACD is bearish.

7. What is advised regarding bottom-fishing?

It is not advisable to bottom-fish in the short term.

8. What should traders do instead of bottom-fishing?

Traders should wait and observe the market.

9. What dates should traders pay attention to in February 2025?

Key dates include February 4, 5, 17, 18, and 24 (UTC).

10. What is the general market sentiment?

The sentiment is bearish, with indications of further downside potential.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

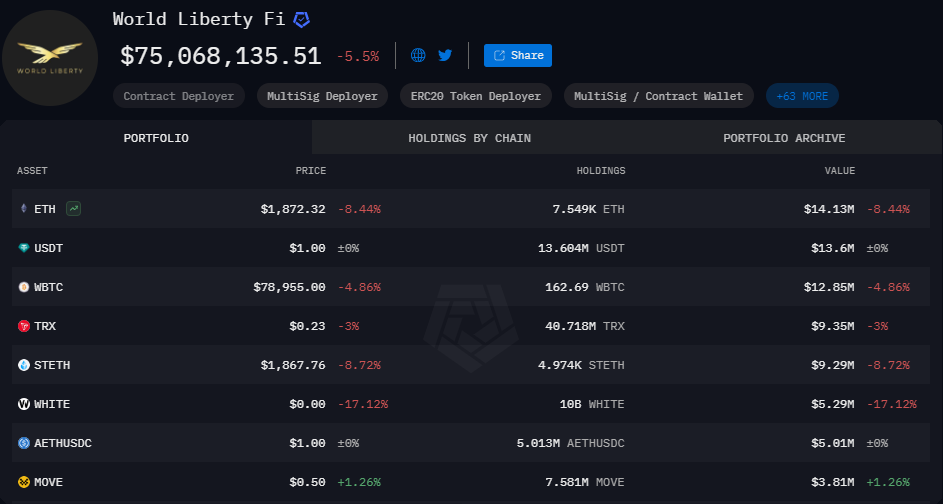

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11