Technical Analysis of Chainlink as of March 4, 2025

The market experienced an upward trend from early October to early December 2024, followed by a decline starting mid-December. Key resistance and support levels were established, with bearish indicators suggesting a continued market downturn.

Article

The financial market experienced a significant and noteworthy trend from early October to early December 2024. This period was characterized by an unwavering upward movement, with many investors showing increased confidence in various assets, contributing to a strong bullish sentiment in the marketplace. However, this optimistic trajectory shifted dramatically around mid-December, when the market began to decline, raising concerns among traders and analysts alike. A particularly important indicator of this shift occurred on December 2, 2024, when a notable bullish candle was formed. This bullish candle typically indicates strong buying pressure, but contrary to expectations, the market was unable to maintain this momentum and subsequently entered an adjustment phase. The adjustment phase marked a transition from rapid growth to a more cautious and reactive approach by market participants, leading to increased volatility. During this time, critical resistance levels were identified at 26.90 and 30.89, which served as important benchmarks for traders. Resistance levels represent price points at which a rising asset is expected to face selling pressure, while support levels indicate where a declining asset might find buying interest. The key support levels were established at 14.01 and 13.47. These benchmarks are crucial because the ability of the market to maintain prices above these support levels could dictate the future course of the market's trajectory. However, the situation took a turn for the worse on February 24, 2025, when a robust bearish candle broke through the key support level situated around 18.00. This breach was not trivial; it transformed the 18.00 support level into a new resistance level, illustrating the market's shift towards a more pessimistic outlook. The breach signaled to investors that the market was entering a more challenging phase, potentially prompting fear-driven selling. December 2 also saw an escalating trading volume, peaking at an impressive 600,000 units. High trading volume typically signifies the strength of a particular trend, and the peak on that day suggested that many traders were looking to capitalize on the upward momentum. However, the subsequent downturn raised questions about the sustainability of the earlier bullish trend. The Moving Average Convergence Divergence (MACD) indicator has also been referenced in the analysis of market momentum. Currently, the readings indicate that both the DIF and DEA lines are positioned below the zero line, which is typically interpreted as a bearish signal, suggesting that the market could continue its downward trajectory. This technical analysis tool is valuable for gauging momentum shifts and helping traders make informed decisions based on historical price movements. Additionally, the prevailing market sentiment remains bearish, highlighting the necessity for cautious observation of the aforementioned key support levels. This sentiment underscores the importance of strategic decision-making moving forward, as any further breaches of these support levels could further exacerbate the current decline. In conclusion, the financial market's dynamic landscape from October to early December 2024 showcased both strength and vulnerability. As market participants navigate this complex terrain, understanding key technical indicators, resistance and support levels, and prevailing sentiments will be imperative in making informed investment decisions. The shift from bullish to bearish sentiment serves as a reminder of the innate volatility present in financial markets and necessitates a vigilant and strategic approach to trading.

Keywords

Chainlink

Chainlink

2025-03-04

Blockenza Analysis

The analysis suggests a bearish sentiment with indicators pointing towards a continued decline in prices.

FAQs

1. What was the market trend from early October to early December 2024?

The market showed an upward trend during this period.

2. When did the market begin to decline?

The market began to decline in mid-December 2024.

3. What did the market do after the bullish candle on December 2, 2024?

The market entered an adjustment phase following the bullish candle.

4. What are the key resistance levels mentioned?

The key resistance levels are at 26.90 and 30.89.

5. What are the key support levels recorded?

The key support levels are at 14.01 and 13.47.

6. What significant event occurred on February 24, 2025?

A long bearish candle broke through the support around 18.00.

7. What was the peak trading volume and when was it observed?

The trading volume peaked at 600,000 units on December 2, 2024.

8. What does the MACD indicator indicate?

The MACD indicates that both the DIF and DEA are below the zero line, suggesting a possible decline.

9. What is the overall market sentiment described?

The overall market sentiment is bearish.

10. Why is it important to monitor the key support levels?

Monitoring the key support levels is crucial as they indicate potential reversal points in the market.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

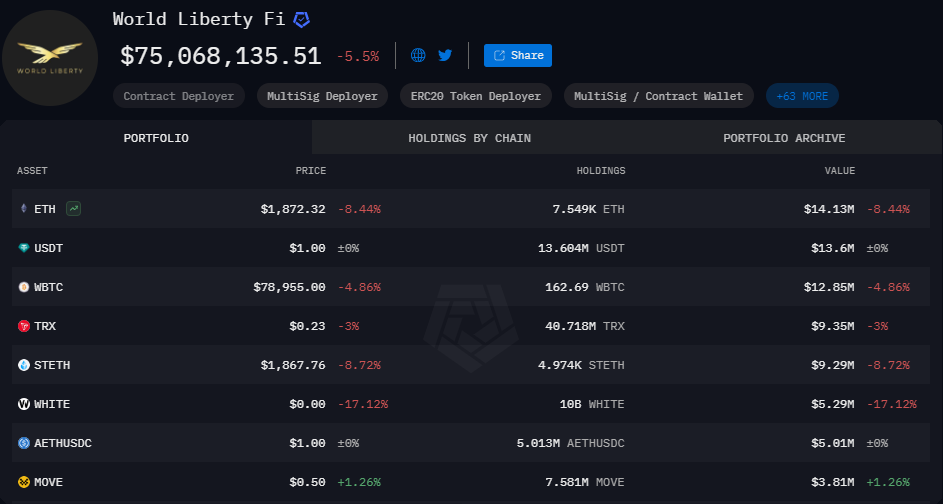

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11