Technical Analysis of Chainlink as of March 9, 2025

From October 2024 to March 2025, the cryptocurrency experienced a rise, fluctuations, and a decline, with key resistance at 19.12 and support at 14.01. Current indicators suggest a bearish trend, urging investors to closely monitor both support and resistance levels.

Article

Between October 2024 and March 2025, the cryptocurrency market experienced significant activity marked by a series of price movements that included a notable ascent, corrections, and an eventual decline. This period was particularly intriguing for traders and investors, as various technical and fundamental factors influenced the market’s behavior. Starting from October 2024, the cryptocurrency under discussion witnessed a remarkable surge in price, drawing the attention of both retail and institutional investors. Investor sentiment was buoyed by growth in adoption rates, improvements in blockchain technology, and overall bullish trends in the broader financial markets. However, as the price began to climb towards mid-November 2024, a noticeable weakening of this upward momentum started to materialize. One of the key technical indicators that emerged during this timeframe was the 'death cross,' which occurred in mid-January 2025. A death cross is typically interpreted as a bearish signal, indicating that the short-term moving average has crossed below the long-term moving average. This chart pattern often signifies a shift in market sentiment from bullish to bearish, raising concerns about the sustainability of the brandishing highs reached earlier in the cycle. As of February 10, 2025, key resistance levels were identified around the price point of 19.12. Resistance levels are crucial in technical analysis, as they represent price points where selling interest may outweigh buying interest, leading to potential price stagnation or reversal. A breakthrough of this resistance could ignite renewed optimism among investors, suggesting that further price increases might be on the horizon. Conversely, a crucial support level was observed at around 14.01, based on data from February 25, 2025. A breach below this level could trigger a wave of selling, putting additional downward pressure on the price, potentially leading to a more pronounced bearish trend. During this volatile period, trading volume became a significant focal point. High trading volume is often indicative of a strong market sentiment and fierce competition between bullish investors, who are hoping for price increases, and bearish investors, who are anticipating declines. The fluctuations in trading volume during this time contributed to the overall market dynamics as participants reacted to the shifting technical signals and macroeconomic conditions. From a technical analysis perspective, the current moving average system displayed a bearish alignment, confirming the downward trend highlighted by various indicators. Furthermore, the Moving Average Convergence Divergence (MACD) indicator provided additional insights, showing that both the DIF (the difference between short-term and long-term moving averages) and DEA (the signal line) were positioned below the zero line. This further reinforced the notion that downward pressure was intensifying, which warranted caution from traders. Given these observations, it is pivotal for investors to remain vigilant and to closely monitor price movements, especially as they approach the identified support and resistance levels. Strategic risk management is essential in such a volatile environment, as market participants navigate the challenges and opportunities presented by this current cycle. In conclusion, this cryptocurrency’s journey through late 2024 and early 2025 exemplifies the complexities inherent in market dynamics, influenced by both technical indicators and evolving investor sentiment. As the market continues to unfold, informed and deliberate analysis will become indispensable for making astute investment decisions.

Keywords

Chainlink

Chainlink

2025-03-09

Blockenza Analysis

The analysis indicates an overall bearish trend with increasing downward momentum, reflecting a strong likelihood for further price decline.

FAQs

1. What was the trend of the cryptocurrency from October 2024 to March 2025?

The cryptocurrency experienced a rise, followed by fluctuations, and then a decline.

2. What signal indicated the downward trend in January 2025?

A 'death cross' formed in mid-January 2025, signaling a potential downward trend.

3. What is the key resistance level identified?

The key resistance level is approximately 19.12.

4. What could happen if the resistance level at 19.12 is broken?

A breakthrough at this level could lead to further price increases.

5. What is the key support level for this cryptocurrency?

The key support level is around 14.01.

6. What does a breakdown of the support level indicate?

A breakdown could lead to further downside movement.

7. What is indicated by the moving average system?

The moving average system is in a bearish alignment, confirming the downward trend.

8. What do the MACD indicators show?

The MACD indicators show both the DIF and DEA are below the zero line, indicating strengthening downward momentum.

9. What advice is given to investors?

Investors are advised to be cautious and monitor the breakthrough of support and resistance levels.

10. What does the trading volume indicate?

The trading volume indicates high market participation and a fierce struggle between bulls and bears.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

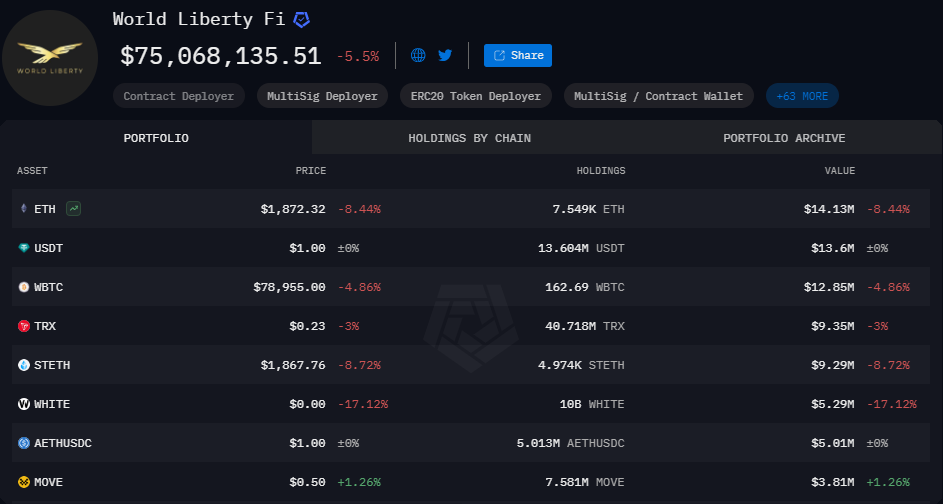

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11