Technical Analysis of Chainlink on 02-03-2025

The cryptocurrency is experiencing a clear downward trend confirmed by technical indicators such as a death cross and bearish MACD. Key support levels are at 14,000 and 10,347, while resistance lies at 19,000 and 27,000, with a potential for an oversold rebound noted.

Article

Cryptocurrencies are known for their volatile nature, and the current climate for a particular cryptocurrency is indicative of this unpredictability as it is currently demonstrating a bearish trend. Analysis of recent chart patterns reveals a pronounced downward trajectory, particularly noticeable from mid to late February 2025 (UTC). Such a decline is often characterized by increased trading volume, which can indicate heightened investor activity, whether they are selling off assets or attempting to capitalize on potential price dips. One of the most significant technical signals at play is the formation of what’s termed a "death cross," which occurs when a short-term moving average crosses below a long-term moving average. This crossover is typically interpreted as a bearish signal, implying that downward momentum could persist over the short term. In conjunction with this, the Moving Average Convergence Divergence (MACD) indicator is also reflecting bearish tendencies, further solidifying the sentiment among traders and investors that the currency may continue its downward spiral in the near future. Investors keen on navigating this volatile market need to keep a close eye on key support and resistance levels. Currently, the cryptocurrency is approaching a preliminary support level around 14,000. The efficacy of this support will be critical, as breaks below significant support levels often lead to further declines. A stronger support threshold lies around 10,347, where buyers may step in, countering the selling pressure. On the flip side, there is also a preliminary resistance level around 19,000, beyond which the market sentiment may start to shift if breached. An even stronger resistance has been identified near 27,000, suggesting that a return to these levels may not be imminent unless there are substantial changes in market sentiment or positive developments within the cryptocurrency ecosystem. Interestingly, a long lower wick appeared on the price chart on February 24 (UTC), suggesting some buy-side interest at lower levels, yet this movement did not significantly alter the overall bearish trend. Such occurrences can hint at localized efforts to sustain the price, but they often require sustained buying pressure to reverse a prevailing trend effectively. Therefore, monitoring the support levels closely remains essential, as they could act as crucial points for the market to either pivot or further decline. As we dissect these indicators, it is important to balance caution with strategic opportunities. Although the price may continue to face downward pressure in the short term, the market also presents the possibility of an oversold rebound. In trading, oversold conditions often lead to price corrections, providing savvy investors with opportunities to buy at lower prices, anticipating eventual recoveries. In summary, the current market data for this cryptocurrency strongly indicates a bearish trend influenced by technical indicators such as the death cross formation and bearish MACD signals. Traders and investors should remain vigilant, closely observing the support and resistance levels, as well as monitoring for any signs of potential reversals in the market. As the cryptocurrency landscape continues to evolve, understanding these dynamics can equip investors with the necessary insights to navigate the complexities of this dynamic market effectively.

Keywords

Chainlink

Chainlink

2025-03-02

Blockenza Analysis

The analysis indicates a strong downward trend with no immediate signs of reversal, leading to a score reflecting bearish sentiment.

FAQs

1. What is the current trend of the cryptocurrency?

The cryptocurrency is currently showing a downward trend.

2. What indicators confirm this downward trend?

A death cross in moving averages and a bearish MACD signal confirm the trend.

3. What is the preliminary support level?

The preliminary support level is around 14,000.

4. What is the stronger support level?

The stronger support level potentially is around 10,347.

5. What is the preliminary resistance level?

The preliminary resistance level is around 19,000.

6. What is the stronger resistance level?

The stronger resistance level potentially is around 27,000.

7. Did the long lower wick change the overall trend?

No, the long lower wick on February 24 did not change the overall trend.

8. What should be monitored for price movements?

The effectiveness of support levels and MACD reversal signals need to be monitored.

9. What is expected in the short term for the price?

The price may continue to decline in the short term.

10. Is there a potential for a price rebound?

Yes, there is a risk of an oversold rebound.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

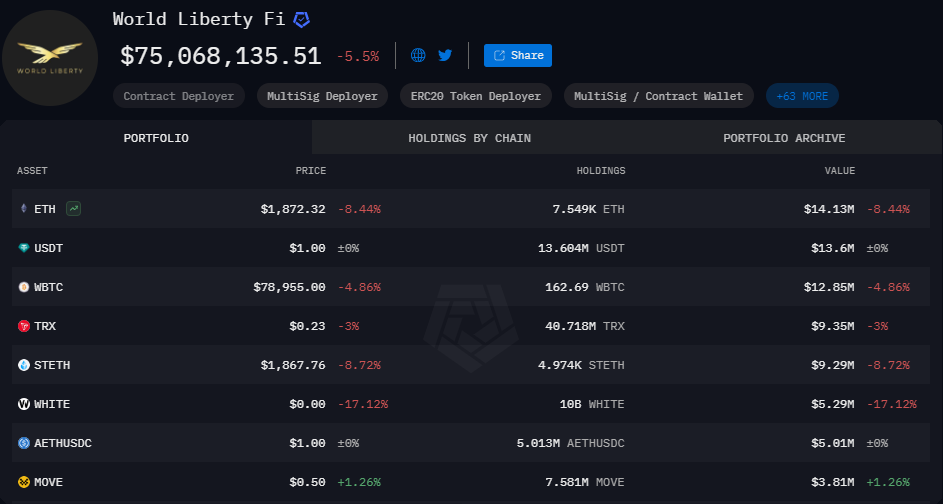

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11