Technical Analysis of Chainlink on March 3, 2025

The cryptocurrency is predicted to rise from October to mid-November 2024, followed by a decline starting in January 2025. Key resistance and support levels have been identified, and caution is advised due to a weak overall trend.

Article

The cryptocurrency market is renowned for its volatility and unpredictability, making the analysis of future trends particularly valuable for investors and enthusiasts alike. A close examination of the projected trajectory of a specific cryptocurrency indicates that favorable price fluctuations are anticipated beginning in early October 2024 and extending through to mid-November of the same year. This period appears poised for growth and could represent an opportune moment for stakeholders to capitalize on potential gains. During this promising phase, it is expected that bullish investor sentiment will linger, driven by various external factors including market demand, technological advancements, regulatory updates, and macroeconomic circumstances that are supportive of digital asset investments. While speculations suggest significant upward movement in price during this timeframe, it is essential to note that this upward momentum will eventually lose steam. Following this intriguing phase of growth, the cryptocurrency is poised to enter a period of adjustment characterized by heightened volatility spanning from December 2024 through January 2025. This transition is not uncommon in the cryptocurrency realm, as the buildup of speculative interest often leads to corrections. Traders and investors should prepare for notable price fluctuations as the market seeks to return to a more sustainable growth trajectory. The cryptocurrency in question may face substantial resistance on several dates, as outlined in the analysis: $26.90 (UTC) on December 2, 2024; $30.89 (UTC) on December 13, 2024; $27.17 (UTC) on January 22, 2025; and $26.37 (UTC) on January 31, 2025. These resistance levels may serve as pivotal points in determining the direction of price movement in the following weeks. Though the year begins with psychological barriers that could inhibit further upward momentum, attention must also be paid to crucial support levels that emerge in early 2025. The identified support levels—$14.01 (UTC) on February 25, 2025; $13.47 (UTC) on February 28, 2025; and $14.23 (UTC) on March 1, 2025—suggest that selling pressure could intensify as the market grapples with the complexities of the downturn. The analysis hints at a steep decline anticipated in early February 2025, which may raise the risk of these support levels being breached. If breached, it could lead to further downward spirals, putting current and potential investors on high alert. Despite an expected minor rebound in early March 2025, the overall trend appears to remain weak and suggests that seasoned investors should approach the market with a measure of caution. Comprehensive risk management strategies should be implemented, including setting stop-loss orders and diversifying investment portfolios, to safeguard against unexpected market shifts. The cryptocurrency landscape is marked by its rapid changes and periodic shocks, often making it perilous yet rewarding. As such, keeping a vigilant eye on price movements, market sentiment, and external factors influencing the field will be essential for attaining success in the unpredictable world of cryptocurrencies. In navigating this intricate landscape, informed decision-making is paramount, allowing investors to adapt and respond effectively to the dynamic nature of the market.

Keywords

Chainlink

Chainlink

2025-03-03

Blockenza Analysis

The analysis indicates an overall bearish trend with expected declines following initial fluctuations, suggesting a weak market outlook.

FAQs

1. What is the expected trend for this cryptocurrency from October to mid-November 2024?

The cryptocurrency is expected to experience an upward fluctuation.

2. When will the trend start turning weak?

The trend will begin to turn weak after mid-November 2024.

3. What happens from December 2024 to January 2025?

The cryptocurrency will adjust and fluctuate during this period.

4. What are the key resistance levels to watch?

Key resistance levels include 26.90 (December 2, 2024), 30.89 (December 13, 2024), 27.17 (January 22, 2025), and 26.37 (January 31, 2025).

5. What are the key support levels specified?

Key support levels are 14.01 (February 25, 2025), 13.47 (February 28, 2025), and 14.23 (March 1, 2025).

6. What does the steep decline in early February 2025 imply?

It may make the support levels fragile and trigger further declines if breached.

7. Is there any expected rebound in early March 2025?

There is a slight rebound expected in early March, but the overall trend remains weak.

8. What is the recommended approach for investors?

Caution is advised due to the weak overall trend.

9. What direction is the price expected to take after January 2025?

The price is expected to decline after January 2025.

10. Are there any significant fluctuations anticipated post-January 2025?

Yes, after January 2025, a clear downward trend is anticipated.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

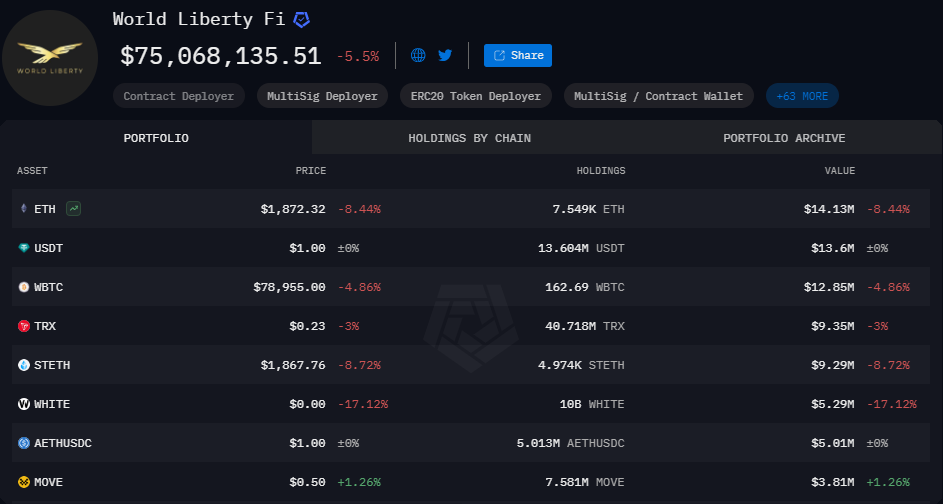

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11