Technical Analysis of Chainlink on March 6, 2025

The cryptocurrency price is experiencing a downward trend with weak rebound strength around key support levels. A cautious approach is recommended as trading volume remains low amid market fluctuations.

Article

The cryptocurrency market is one of the most dynamic and rapidly changing sectors in the financial world, with various factors impacting prices and trends. Currently, the price pattern of a particular cryptocurrency is indicating a downward trend that has been evident from early October 2024 through late February 2025. This trend is characterized by notable price fluctuations, which can be attributed to several market dynamics, including trader sentiment, macroeconomic variables, and regulatory news. One of the significant observations in this price pattern is the pronounced upper wick formed on December 2, 2024, (UTC), which signals a potential loss of upward momentum. An upper wick occurs when the market attempts to push prices higher but ultimately fails to sustain that rise, often resulting in a sell-off as traders take profits or cut their losses. This pattern is critical as it may suggest that bullish sentiment is waning, and sellers are gradually taking control of the market. In analyzing the price action of the cryptocurrency, we can identify key resistance and support levels that are instrumental for traders and investors. The significant resistance levels have been identified at $26.90 and $30.89. These are psychological barriers where many traders may decide to sell their holdings, anticipating that the price may not rise above these points. Conversely, crucial support levels are found at $14.01 and $13.09, which serve as price points where buyers may enter the market to prevent further declines. Recently, the price has been hovering around the $14.00 mark, signaling that this support level is being tested repeatedly, yet there appears to be a distinct lack of robust recovery momentum to push prices higher effectively. Trading volumes have also played a pivotal role in this dynamic. On March 5, 2025 (UTC), a notable increase in trading volume was observed, which could indicate a potential short-term rebound. Increased trading volume often accompanies price movement and can suggest heightened interest or activity among traders. However, it is crucial to remain cautious as overall trading volume has been relatively low in recent days, reflecting a market sentiment that is fraught with caution. The implication of low trading volume often suggests that traders are either waiting on the sidelines for more favorable conditions or that the broader market context is causing hesitancy. With this in mind, those involved in the cryptocurrency market should prepare for continued fluctuations and possible consolidation phases in the near term. The recurrent testing of support levels and resistance will create a battleground for bulls and bears, with market volatility likely continuing until clearer trends emerge. Given these considerations, it is sagacious for investors and traders to maintain a cautious and observant approach. While the hope for a rebound exists, relying on overly optimistic expectations may lead to unintended losses, particularly in a market that has demonstrated such volatile pricing. Successful trading in cryptocurrency often hinges on thorough analysis, emotional discipline, and the ability to adapt to rapid changes in market sentiment. In conclusion, as this cryptocurrency trades within these established ranges, it remains imperative to keep an eye on market indicators and to make informed decisions based on emerging trends and volatilities.

Keywords

Chainlink

Chainlink

2025-03-06

Blockenza Analysis

The analysis indicates a bearish trend in the price with weak support levels and a cautious market sentiment.

FAQs

1. What is the trend in the cryptocurrency's price pattern?

The cryptocurrency's price pattern shows a downward trend with fluctuations.

2. What does the upper wick on December 2, 2024, indicate?

It may signal a weakening of the upward momentum.

3. What are the key resistance levels for this cryptocurrency?

The key resistance levels are at 26.90 and 30.89.

4. What are the key support levels?

The key support levels are at 14.01 and 13.09.

5. Is there any support recently observed in the price?

Yes, the price has found support around 14.00.

6. What was observed on March 5, 2025?

There was a surge in trading volume, which may signal a short-term rebound.

7. What is the current market sentiment?

The market sentiment is one of caution.

8. What approach is recommended for investors?

A cautious wait-and-see approach is recommended.

9. Is it advisable to be overly optimistic?

No, it is not advisable to be overly optimistic given the current market conditions.

10. What may happen in the near future with the market?

The market may continue to fluctuate and consolidate.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

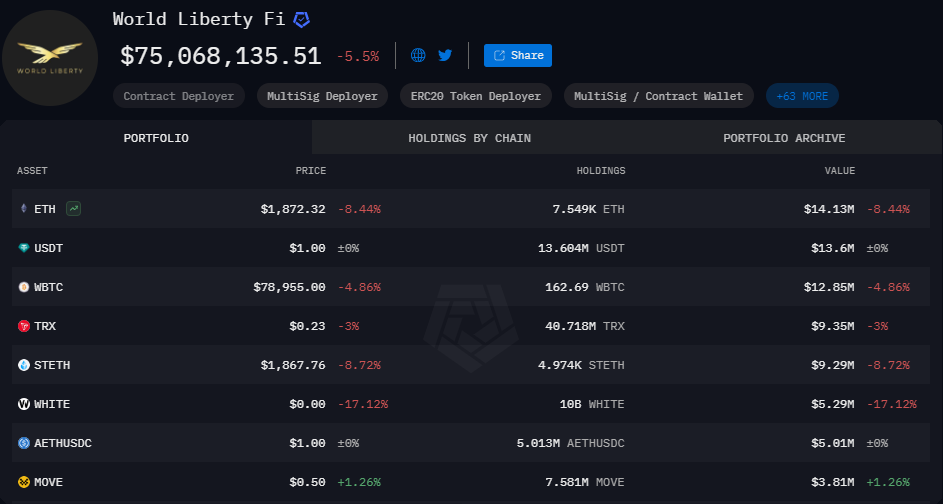

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11