Technical Analysis of Chainlink on March 7, 2025

The market has gone through several phases from October 2024 to March 2025, currently adjusting after a decline. Key chart indicators suggest bearish sentiment but hint at a potential short-term rebound.

Article

From October 2024 to March 2025, the financial markets exhibited a complex tapestry of fluctuations characterized by periods of upward trends, volatility, and downward movements. This six-month timespan evidenced a noteworthy decline that incited a necessary period of market adjustment. Through chart analysis, critical insights into market dynamics can be discerned, contributing to strategic investment decisions. One of the most pertinent observations during this timeframe is the pronounced long upper wick identified on December 2, 2024 (UTC). This phenomenon often signals substantial selling pressure, indicating that as prices rose, they were subsequently met with overwhelming resistance, pushing the prices back down. Such movements can often denote market sentiment shifts, where investor confidence is challenged, urging traders to reassess their positions. Additionally, technical analysis highlights the emergence of an engulfing pattern on February 24 and February 25, 2025 (UTC). This specific candlestick formation occurs when a smaller candle is followed by a larger candle which completely engulfs it, conveying a powerful reversal signal. In this instance, the occurrence of this pattern is aligned with the broader downtrend, reinforcing the bearish sentiment prevailing in the market. Consequently, this suggests that the sellers are firmly in control of the market narrative during this period, further validating the need for cautious investment strategies. Resistance and support levels are crucial data points for traders to interpret market conditions effectively. In this analysis, resistance levels have been marked at 26.90 and 19.86, which signify price points where selling pressure may increase, preventing further upward movements. Conversely, significant support levels are identified at 14.01 and 13.09. These levels indicate where buyers may re-enter the market to prevent prices from falling further. Understanding these dynamics allows investors to better navigate their trading strategies, placing buy orders near support levels and sell orders near resistance levels. Moreover, the trading volume peaked at an impressive 601,807 units on December 2 (UTC), which is a strong indicator of heightened market activity. A surge in trading volumes often reflects increased investor interest, highlighting critical turning points in market trends. In contexts such as these, it becomes imperative for traders to remain informed, as fluctuations in trading volume can precede significant price movements. The MACD (Moving Average Convergence Divergence) indicator further elaborates on market conditions, indicating that while bearish sentiment prevails, there are signs of weakening momentum. This observation may suggest that the market could be ripe for a rebound. As such, investors might anticipate a short-term technical recovery in prices, although it is crucial to approach this with caution. The medium-term forecasts still indicate the possibility of additional downward pressure, meaning that any rebounding price action should be approached with prudence. In conclusion, the period spanning from October 2024 to March 2025 has been marked by turbulent market actions warranting careful consideration. Investors are advised to closely monitor support and resistance levels, remain attentive to trading volumes, and analyze technical indicators such as MACD to inform their strategies. In times of volatility and uncertain outcomes, a well-informed investor is better equipped to navigate the shifting tides of the financial markets, ultimately positioning themselves for potential opportunities while mitigating risks. Hence, vigilance and continuous review of market conditions will be paramount for success in the upcoming trading sessions.

Keywords

Chainlink

Chainlink

2025-03-07

Blockenza Analysis

The analysis points towards a potential short-term rebound due to weakening bearish momentum, but the overall market sentiment remains bearish, justifying a cautious approach.

FAQs

1. What were the market trends from October 2024 to March 2025?

The market exhibited an upward, volatile, and then downward trend, leading to an adjustment phase.

2. What does the long upper wick on December 2, 2024, indicate?

It suggests significant selling pressure.

3. What do the engulfing patterns on February 24 and 25, 2025, confirm?

They confirm the ongoing downtrend in the market.

4. What are the key resistance levels identified?

The key resistance levels are at 26.90 and 19.86.

5. What are the identified support levels?

The support levels are at 14.01 and 13.09.

6. How high did the trading volume peak on December 2, 2024?

The trading volume reached a peak of 601,807 units.

7. What does the MACD indicator suggest about market sentiment?

It shows the bears have a slight advantage, but momentum is weakening.

8. Should investors be cautious in the current market?

Yes, investors are advised to be cautious and monitor support and resistance levels.

9. What is the short-term outlook for the market?

A technical rebound may occur in the short term.

10. What is the medium-term outlook for the market?

The medium-term outlook still faces downward pressure.

Related Articles

In this section, you will find articles and analyses related to this post. These materials will help you gain more information about the topic and develop a broader perspective on the digital currency market. By reading these articles, you can make more informed and precise decisions in your investment journey.

Missed Out on Chainlink? Discover Why Qubetics is the Crypto Coin to Invest in 2025

The cryptocurrency market is evolving rapidly in 2025, offering new investment opportunities. Qubetics is gaining attention as a promising alternative to established names like Bitcoin and Ethereum.

Chainlink

Chainlink

2025-03-11

Astra Nova’s Rapid Rise: $3.5M Funded, Over 210K Gamers Engaged, and a $45 Million Valuation Sparks TGE Excitement

Astra Nova is a dynamic player in the Web3 gaming space, having raised $3.5 million and engaged over 210,000 gamers, leading to a $45 million valuation. Their innovative Black Pass Questing Platform and strategic partnerships signal significant potential in the gaming industry.

Chainlink

Chainlink

2025-03-11

BlockDAG and SpaceDev Partnerships: Navigating Challenges for Solana and Dogecoin

Strong alliances are crucial for the success of blockchain projects, with Solana and Dogecoin facing distinct challenges in the market. While Solana grapples with volatility and Dogecoin suffers from a lack of utility, BlockDAG is effectively enhancing its position through strategic partnerships.

Chainlink

Chainlink

2025-03-11

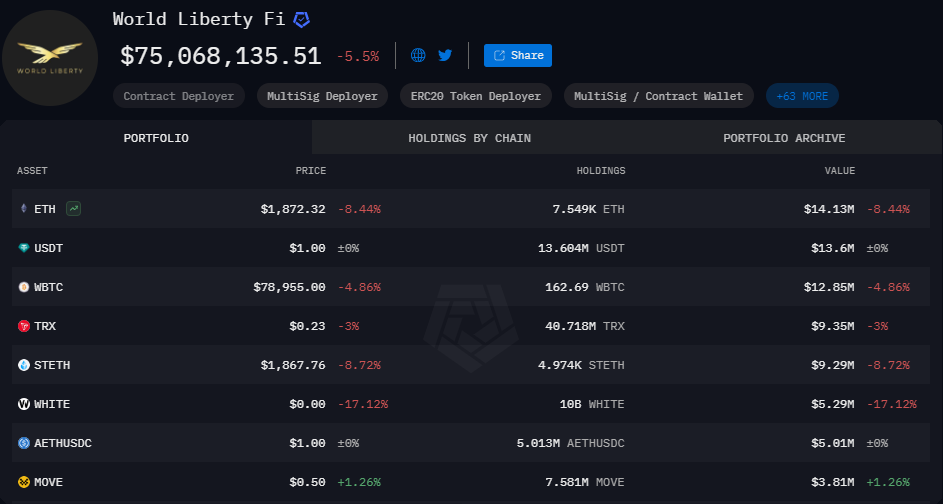

World Liberty Financial Nears Completion of WLFI Tokens Presale

World Liberty Financial is close to finalizing the presale of WLFI tokens, needing only $2 million to proceed to the next stage. The presale has garnered significant interest and is on track for completion, despite potential external market fluctuations.

Chainlink

Chainlink

2025-03-11

Stablecoins Market Capitalization Reaches Historic High of $204.7 Billion

The market capitalization of the top five stablecoins has reached an all-time high of $204.7 billion, indicating a significant shift by investors towards safer, cash-like instruments amidst market uncertainty. This trend reflects a growing aversion to riskier assets and highlights the increasing reliance on stablecoins.

Chainlink

Chainlink

2025-03-11

Chainlink Anticipates Market Recovery with $350 Trillion Opportunity

Sergey Nazarov, Chainlink's founder, predicts a $350 trillion market value for blockchain integration in traditional finance, with significant collaboration efforts in place. Despite a price drop since late 2022, Chainlink's long-term potential remains strong due to partnerships with institutions and government interest in its technology.

Chainlink

Chainlink

2025-03-11